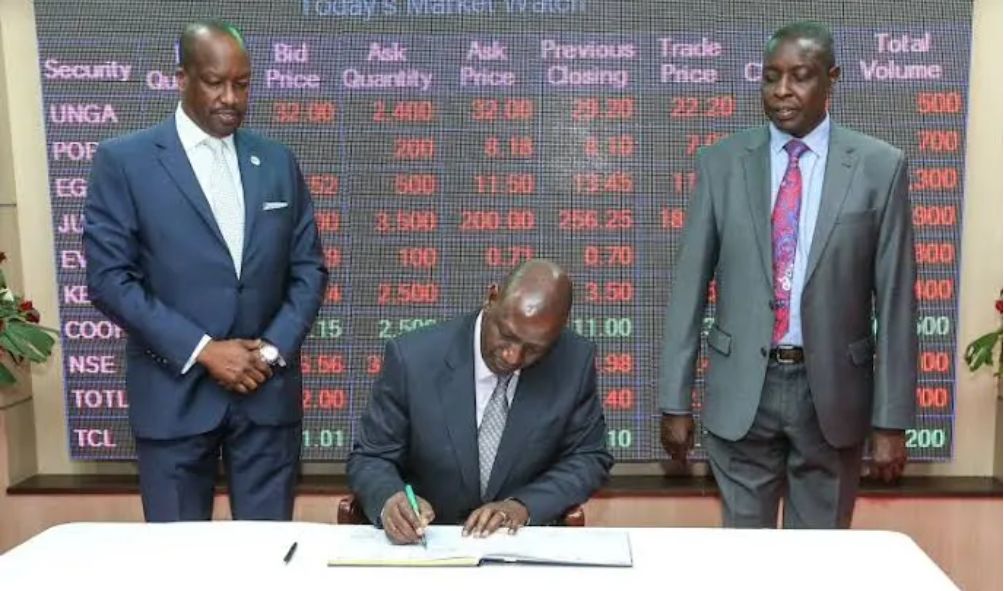

Foreign investors continue mass exodus from the Nairobi Securities Exchange

Foreign investors have sold off equities worth KSh 2.3 billion, demonstrating their continued exodus from the Nairobi Securities Exchange (NSE)

Foreign investors have sold off equities worth KSh 2.3 billion, demonstrating their continued exodus from the Nairobi Securities Exchange (NSE).

Despite a steady improvement in the performance of local equities, recent market data indicates that foreign investors continued to withdraw from the Nairobi Securities Exchange (NSE) until the quarter ending March of this year.

Data reveals that foreign investors’ portfolio flows were negative for each of the three months, with the largest selloff, at Sh1.2 billion, occurring in March.

Investors withdrew Sh106 million and Sh1 billion from the market in January and February, respectively.

Notwithstanding favorable factors, such as increases in the value of the local currency and heightened investor confidence in the sovereign after Kenya’s first $ 2 billion (Sh264.85 billion) Eurobond partially redeemed, the withdrawals are still occurring.

The pattern points to a lack of trust in the Kenyan market, although local equities have been showing a gradual improvement in performance.

The East African reported that the ongoing exodus of foreign investors has been associated with a discrepancy in returns, whereby investments made in developed economies provide higher returns than those made in emerging and frontier economies such as Kenya due subsequent to significant interest rate hikes.

Ruto makes new appointments to UDA leadership; announces dates for party elections

SRC oppose plans to lower mandatory retirement age from 60 to 55 years

Kenya Power warns of blackouts ahead of heavy rains

Diplomatic vehicle impounded by NTSA officials

Government mulls new taxes for Kenyans with idle land

Rufas Kamau, the lead market analyst at FX Pesa highlighted rising energy costs and taxation as reasons why foreign businesses were closing their doors.

He noted that multinational corporations left the Kenyan market due to low consumer demand, high borrowing rates, and high fuel costs.

“The super-rich people find comfort in a country with a stable taxation policy, a stable currency, and a growing economy,” Kamau said. Why did De La Rue exit Kenya? De La Rue De La Rue exited the Kenyan market due to low demand for printing notes from the Central Bank of Kenya (CBK).

The firm reported a 58% slump in its net profit from the Kenyan wing, from KSh 184.5 million to KSh 76.9 million.

The banknotes printer spent an extra KSh 258 million to lay off staff in January. Its overall expenditure for shutting down the Nairobi unit stood at £13.9 million (KSh 2.3 billion).

Also read,

IG Koome responds after criticism by Ruto allies over insecurity in North Rift

Kenyatta Hospital issues 7-day ultimatum over 541 unclaimed dead bodies

Raila’s ODM announces death of party official

Wife of officer attached to Ruto Presidential Escort shot after scuffle

TEN people confirmed dead after multiple car accident along Mombasa – Nairobi Highway

Russia launches Hi-fly unmanned taxi in Kenya

Follow us