Government proposes increasing tax-free per diem allowances for private employees

Government proposes increasing tax-free per diem allowances for private employees

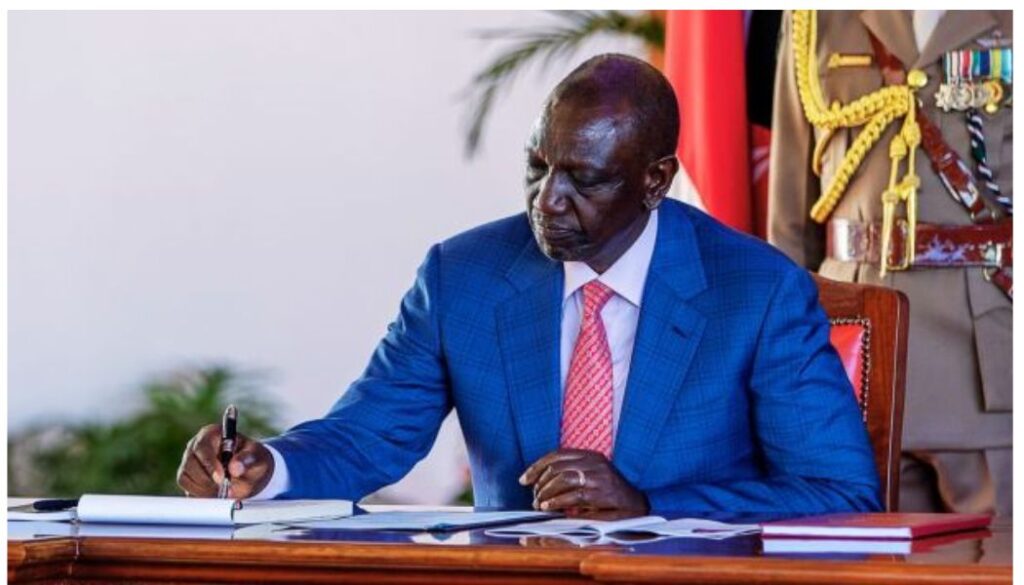

Privately employed Kenyans are set to fill their pockets with more tax-free payouts after the Cabinet passed the Finance Bill 2025 on Wednesday, April 30.

In a subsequent post by the Head of Presidential Special Projects and Creative Economy Coordination, Dennis Itumbi, on Thursday, he revealed that among the changes proposed in the new bill was the increase of non-taxable per diem from Ksh2000 to Ksh10,000.

Per diem is typically the allowance employees receive per day when they travel for work. It covers non-work expenses such as meals, accommodation, transport or local travel, and other minor expenses.

Typically, Kenyans would receive the allowance tax-free if the amount payable was less than Ksh2000. This new proposal will have Kenyans who receive up to Ksh10,000 per diem to enjoy it untaxed.

This is part of the government’s plan to introduce tax relief in the Finance Bill 2025 and address loopholes related to tax expenditures instead of introducing new tax measures.

Although the entire cabinet despatch is not available for public scrutiny, this is the second benefit that will directly impact employees for the better.

In the new finance bill, employers will also be required to automatically apply all eligible tax reliefs and exemptions when calculating Pay As You Earn (PAYE) taxes for employees.

Ksh4.3 trillion budget estimate to undergo revision as Cabinet approves Finance Bill 2025

Cabinet approves opening of a Consulate General in Haiti

Government flags 58 betting websites operating without authorization [Full List]

‘State-sponsored’ Karua responds to Morara Kebaso’s remarks on oppostion leaders meeting

Al-Shabaab militants kill 5 non-local quarry workers in Mandera

The new measure was proposed after reports that some employers often omit the reliefs, forcing their employees to seek refunds from the Kenya Revenue Authority (KRA).

“Currently, many employers omit these reliefs, forcing employees to seek refunds from the Kenya Revenue Authority. These reforms underpin the Bottom-Up Economic Transformation Agenda (BETA) and reinforce the government’s commitment to building a stronger, more inclusive economy.”

Some Kenyans also reportedly used the tax refund claims loophole to siphon funds from public coffers, such as through inflated tax refund claims.

These loopholes are what the government stated it is seeking to seal in the new Finance Bill 2025, including shedding the national budget to reduce the cost of living for Kenyans.

An example listed by Itumbi was ten companies that were seeking tax claims worth Ksh10 billion in three sectors.

Cabinet orders all employers to calculate employee tax reliefs and exemptions on PAYE to relieve KRA

UNHRC Council to review Kenya’s human rights record starting May

Win for Judges as Cabinet approves retirement benefits

Government responds to BBC ‘Blood Parliament’ documentary

Nigeria names 4 Kenyans in wanted list

IG Kanja, DCI Boss Amin forced to remain in chopper for an hour after residents chase police

Follow us