Housing levy will be inclusive of basic salary and all allowances, KRA says in update to employers

The Kenya Revenue Authority (KRA) clarifies how the housing levy will be deducted from employees' salaries; (inclusive of basic salary and cash allowances)

The Kenya Revenue Authority (KRA) clarifies how the housing levy will be deducted from employees’ salaries; (inclusive of basic salary and cash allowances)

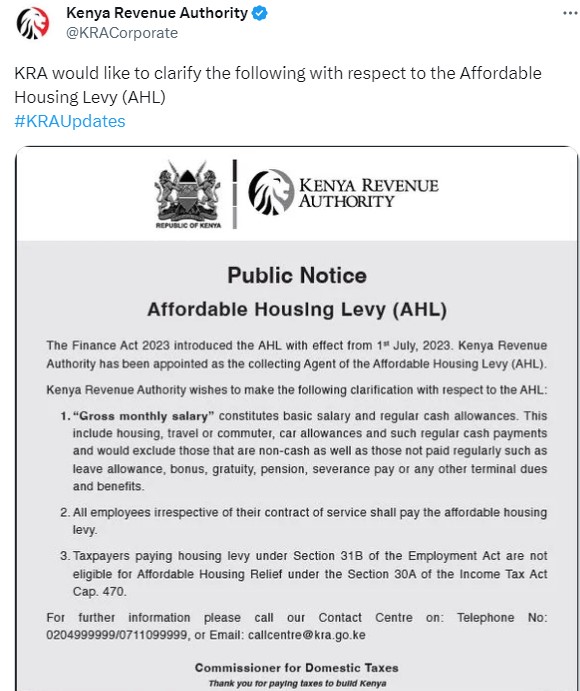

KRA in a statement on Tuesday, August 15, stated that the housing levy will deducted from the basic salary and other allowances.

“Gross monthly salary constitutes basic salary and other regular cash allowances.

This includes housing, travel or commuter, car allowances and such regular payments and would exclude those that are non-cash as well as those not paid regularly such as leave allowance, bonus, gratuity, pension, gratuity, pension, severance pay or any other terminal dues or benefits.

All employees, irrespective of their contract of service, shall pay the affordable housing levy,” KRA stated.

The clarification by KRA comes after it was appointed as the collection agent of the levy.

Ruto goes against IMF as he reinstates fuel subsidy in a big u-turn

Azimio, Kenya Kwanza demands after bipartisan meeting

Parliament warns Kenyans after KEBS importation of 78,000 defective gas cylinders

In an internal circular, KRA ordered its officers to follow specific dates provided for in the Finance Act 2023 while implementing tax changes.

This was after the the government backdated the housing tax to July 1 following the Court of Appeal decision to lift the suspension of the Finance Act 2023

“All officers are advised to read this circular and the specific provisions of Finance Act 2023. Further, officers are advised that the provisions of the Act shall come into effect on the dates specified in Section 1 of the Act.”

According to the new housing tax, employees will be deducted 1.5% of their gross monthly income to fund the affordable housing programme, as the employer matches the same contribution.

Also read,

Uganda accuses Kenyans of rushing to take Ugandan IDs to influence its next general elections

Kuccps extends deadline for inter-university transfers

Police respond to claims of Raila-IG Koome peace talks

Commonwealth election observer group issues an appeal to Kenya over corrupt leaders

Trade CS Kuria proposes the introduction of 25 percent tax on imported clothes, Mitumba

Follow us