Kenyans to feel the pinch as the second round of taxes under the Finance Act 2023 takes effect tomorrow

The second raft of taxes under the controversial Finance Act 2023 will be effected from Friday, September 1

The second raft of taxes under the controversial Finance Act 2023 will be effected from Friday, September 1.

The second round of new taxes introduced through the contentious Finance Act 2023 are set to take effect on Friday, whose impact will be felt across several sectors of the economy.

Cement, steel, and paper prices will increase while suppliers and digital content creators feel the pinch.

From Friday, September 1, the sale of cryptocurrencies, content, music, ebooks, photos, documents, videos, logos, animations, illustrations, and social media accounts, among other digital assets, will attract a 3.0 percent tax.

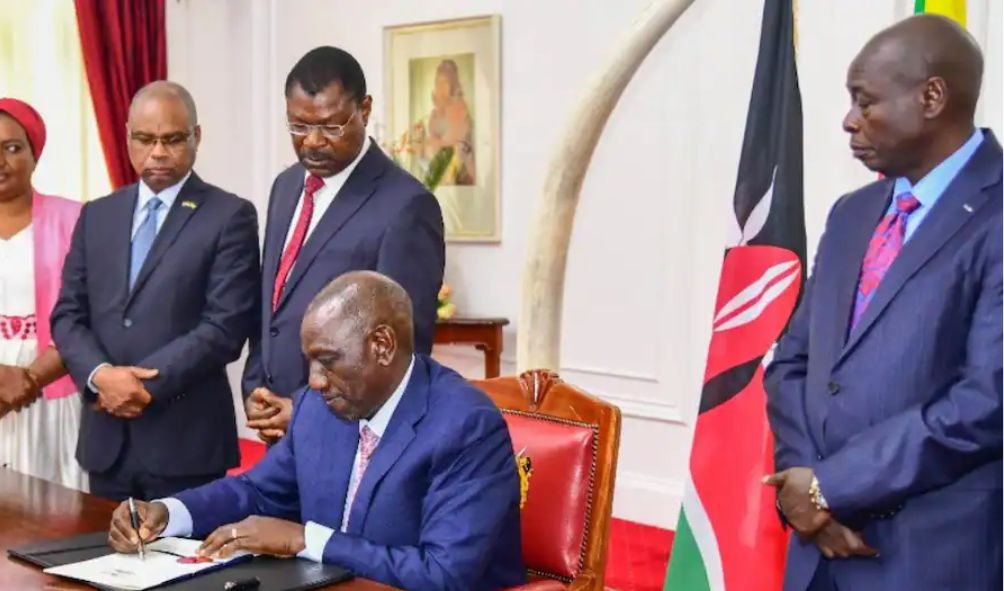

In an effort to contribute to the digital economy and reach its Sh2.7 trillion tax goal for the current fiscal year, President William Ruto’s administration would impose the digital assets tax (DAT) on revenue obtained from digital assets.

As part of the State’s efforts to safeguard the local industry, imported clinker, a raw material used to make cement, as well as finished iron and steel, will begin to be subject to a 17.5 percent Export and Investment Promotion Levy starting this Friday.

Additionally, a 10% export fee will start to apply to imported paper, sacks, and bags.

The implementation of the computerized tax system, however, which would give the Kenya Revenue Authority (KRA) more visibility of transactions taking place in the economy and stock levels held by enterprises, is one of the most significant tax policies whose repercussions will be felt widely among suppliers.

Why Ruto fired contractors on a roadside rally

Ruto reiterates ‘journey to heaven’ as one party withdraws from Mumias case after threats

List of issues agreed by Azimio and Kenya Kwanza to be discussed in the bipartisan talks

Ousted Ali Bongo begs for help as EU calls for a crisis meeting over Gabon coup (VIDEO)

Nyayo House clean up; Four passport brokers arrested

The KRA has been given the authority by the new Act to set up an electronic system whereby electronic tax invoices must be issued and stock records must be maintained for the purpose of tax compliance.

Failure to abide by the Electronic Tax Invoice Management Systems (eTIMS), which mandates that companies generate electronic invoices, would result in a higher fine of Sh200,000, which is double the amount of tax that is owed.

Meanwhile, KRA backdated all taxes that were due on July 1, after the court lifted the suspension of Finance Act 2023.

These included the 1.5% Housing Levy, 35% PAYE for workers earning over KSh 800,000 per month, and 32.5% for workers earning between KSh 500,000 to KSh 800,000.

In addition, KRA issued a directive to employers to collect the 1.5% housing tax missed in July 2023 and match the same in the August payroll.

The taxman called on employers to be compliant, failure to which they risk a 2% penalty of the unpaid funds.

Also read,

Concerns over missing details on Ksh 13b World Bank loan

Gabon coup leaders name General Brice Oligui Nguema, cousin to Bongo as new leader

Wagner chief Prigozhin secretly buried without fanfare in public cemetery

Babu Owino announces his ambitions for 2027 Nairobi Gubernatorial seat

Reprive for Kenya as donors halt termination of funding

Follow us