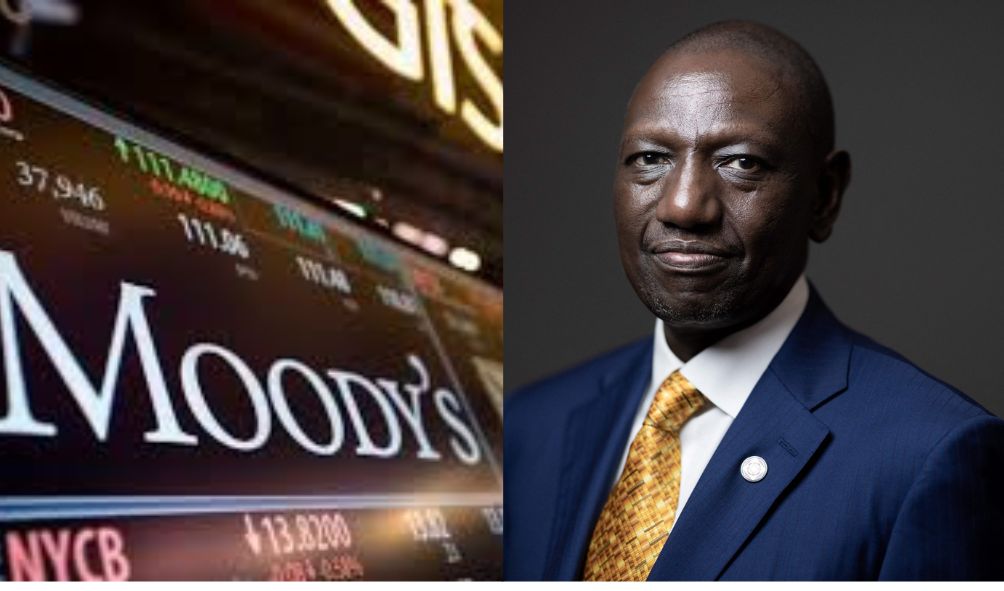

Kenya’s Eurobond plunge after Moody’s Investors Service warning

Kenya risks defaulting on some of its international debt obligations if it goes ahead to buy back half of Eurobond before maturity in 2024 according to Moody's Debt Service

Kenya risks defaulting on some of its international debt obligations if it goes ahead to buy back half of Eurobond before maturity in 2024 according to Moody’s Debt Service.

Kenya’s Eurobonds plunged after Moody’s Investors Service said it may treat a planned buyback of some of the debt as a default.

Redeeming the bonds at a price below par value would constitute an economic loss to investors, David Rogovic, a vice president and senior credit officer at Moody’s, said in response to Bloomberg’s emailed questions.

He was commenting on President William Ruto’s plan, announced in June, to buy back half of the country’s $2 billion of 2024 Eurobonds before the end of this year.

“We deem a distressed exchange occurs when there are economic losses to creditors and when the transaction has the effect of allowing the issuer to avoid a likely eventual default,” Rogovic said.

“We need to see the details and the terms of the buyback before we can assess whether it constitutes a distressed exchange, and therefore a default under Moody’s definition.”

Moody’s does not support the premature buyback of Eurobond as it deems the Kenyan government has sufficient financing options to repay at maturity.

Kenya’s debt burden has been a focal point for investors as the country faces dollar shortages amid skyrocketing energy and food import bills.

Employees to suffer double taxation in August as State backdates deductions to July 1

Uhuru should have been honest with Raila over the 2022 elections

Kenyan traders ditching US dollar for Chinese Yuan; Kenya Bankers Association

Worldcoin responds after its suspension in Kenya

Kenya seeking ill-gotten wealth stashed abroad in extradition rules

With central bank hard currency reserves standing at just $7.4 billion, some investors have been nervous that it would be forced into a debt restructuring, following other African nations including Ghana and Zambia.

“We think the government has sufficient financing options to repay 2024 Eurobond,” Rogovic said.

Concerns about Kenya’s ability to repay the 2024 bonds were cited by Fitch ratings in July, when it revised the outlook on the country’s debt to negative while affirming its credit rating at B, or highly speculative.

Moody’s, which rates the debt B3, cut its outlook to negative last week, saying Kenya would face “substantial” debt-service costs even after redeeming the 2024 notes. S&P Global Ratings, which also has a negative outlook on the credit, will release ratings update on August 25.

Kenya’s other Eurobonds also declined on Wednesday, with the yield on benchmark 2032 notes rising 18 basis points to 10.73%.

Also read,

Worldcoin did not reveal true intentions during registration Kenya, Report

US issues travel advisory for Kenya

EPRA promises cheaper cooking gas as low-cost LPGs hits the market

Where did Russian fertilizer donation to Kenya go

Mistrust brewing as ODM accuses Kenya Kwanza of picking hardliners for Ruto-Raila talks

Follow us