KRA suspends nil tax filings

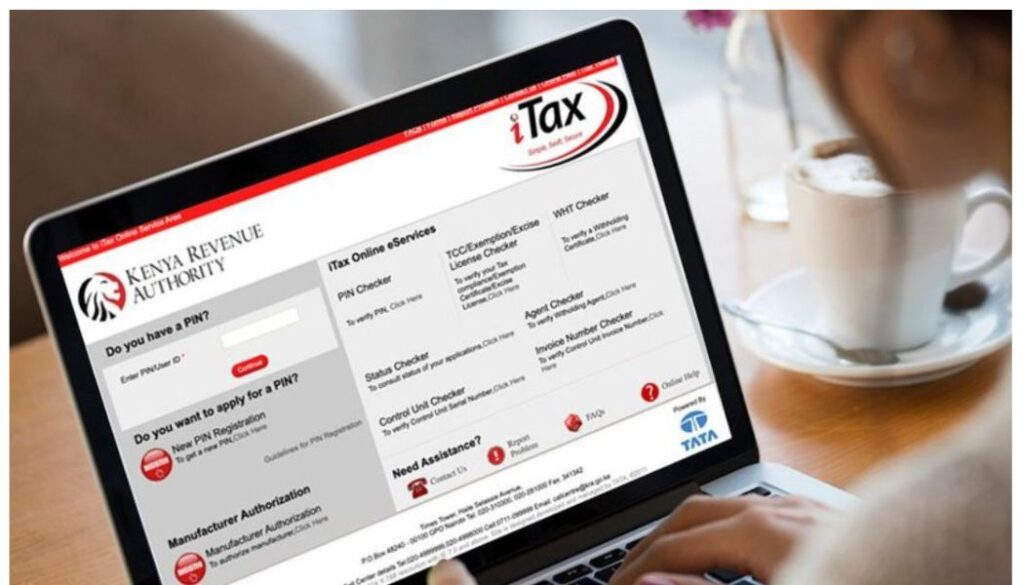

Kenya Revenue Authority (KRA) has temporarily blocked the filing of nil tax returns until the end of March in a bid to convert nil filers and non-filers into active taxpayers.

The Kenya Revenue Authority (KRA) has temporarily blocked the filing of nil tax returns until the end of March in a bid to convert nil filers and non-filers into active taxpayers.

The development was confirmed by Deputy Commissioner Patience Njau during a press briefing on Friday, where she explained that the move will allow KRA to comb through data and ensure compliance among all registered taxpayers.

Amid the announcement, there has been some uncertainty over how long the suspension will remain in effect, with concerns that taxpayers will now have a shorter window to meet the June filing time limit.

During the suspension period, KRA teams will focus on auditing other transactions, including income taxes, withholding taxes, eTIMs, and customs records, to identify those who have not been captured in the tax net.

Njau said, “This year, our focus will be very different as we aim to convert the nil and non-filers and zero payers into paying taxpayers. We have systems in place to monitor other transactions, such as withholding tax, income earned, eTIMs, and customs, among others.”

She added, “To mitigate the risks of missing out on that section, at this time, we will not be filing nil returns until the validation is done. Between now and March 30, you cannot file your 2025 income tax return.”

North Eastern journalists were threatened to boycott my interview; Gachagua

Katwa Kigen, Ahmed Issack Hassan among 15 nominated for Judge of the Court of Appeal (List)

KUCCPS releases 2026 list of institutions eligible for HELB and government scholarships

The move comes amid concerns that many Kenyans, despite earning taxable income, continue to file nil returns to evade taxes.

KRA noted that the suspension is also intended to spread the tax burden more evenly, as historically, most revenue has been contributed by monthly income earners, leaving many others, such as rental income earners, outside the tax bracket.

The authority revealed that out of 22 million registered individuals with KRA PINs, only 8 million actively pay taxes, and of these, just 4 million consistently meet their tax obligations, limiting the government’s ability to maximise tax revenue.

Kenyans have also been reminded that, starting in January, KRA will validate all income and expenses declared in tax returns against its data sources, including TIMS/eTIMS invoices, withholding tax gross amounts, and customs import records.

UDA announces costs for tickets for aspirants seeking nomination for 2027

Safaricom to cover airtime, data for affordable housing interns

Northern Kenya journalist boycott Gachagua interview

High Court declares UDA-ANC merger unconstitutional

Follow us