Safaricom set to offer interest-free loans for shopping

Safaricom eyes the return of interest-free loans for shopping goods of up to Sh100,000 and pay later

Safaricom eyes the return of interest-free loans for shopping goods of up to Sh100,000 and pay later.

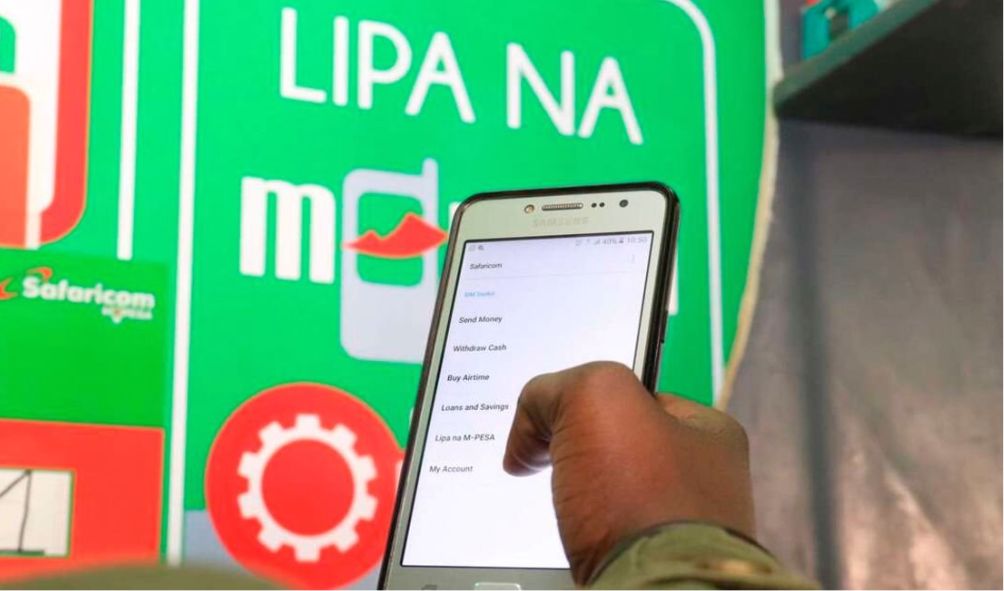

Safaricom is working on the return of a zero-interest credit service for the purchase of goods that was last year blocked by the Central Bank of Kenya (CBK) hours before the launch.

The chief executive of Safaricom, Peter Ndegwa, stated that the telecom is making improvements to the “Faraja” product as requested by the CBK and that the product will “surely show up.”

The owner of the Faraja product is EDOMx Ltd, a financial technology company with offices in Kenya that has named Equity Bank and Safaricom as its partners.

“I am sure it will show up. We needed to change a few things. We will bring it back. It needs to be approved normally just in the same way CBK approves (other products). It is a use case that customers want. You will see it come back,” said Mr Ndegwa.

Faraja was to allow millions of Safaricom customers to shop for goods up to Sh100,000 and pay later, without interest, in a move that was going to disrupt the mobile loans market.

The product was set for launch on July 6 last year based on media invites and Safaricom had loaded the terms and conditions of the product but the CBK stopped the event.

It is not clear the changes the CBK wants Safaricom and its partner to make on the product that was promising normal M-Pesa transaction charges as the only cost at the point of sale and pay within 30 days.

Ruto changes tune on Ksh.300 cheaper cooking gas “not possible”

Housing levy should be voluntary, Employers Federation says

Raila orders Azimio MPs to reject Ruto’s tax proposals

Before launching a product, the CBK demands that regulated firms provide features, terms of agreement for customers, fees charged, and proof of measures to guard against risks.

Other conditions are the viability of the product, tax implications, and evidence it will not contravene statutory or prudential requirements.

The CBK further requires firms to disclose the complaints redress mechanisms, ensure confidentiality of consumer data and refrain from coercive selling and placing the customer under undue pressure.

Faraja is slightly similar to the ‘Lipa Later’ service in the market, only that, this time, shoppers will walk away with the goods from a list of selected merchants without being required to pay upfront in installments.

Safaricom and Equity were looking at making money from Faraja on the surge in Lipa na M-Pesa transactions at select stores.

Dozens of outlets, including Naivas Supermarket, Goodlife Pharmacy, and City Walk had signed up to be merchants.

Also read,

More pain as EPRA increases fuel prices

US introduces Citizenship Act 2023 to eliminate country quota for Green Cards

Petroleum dealers warn of an increase in fuel prices to about Ksh200

Alarm as public hospitals runs out of stock of common drugs- leaked report

Follow us