Tax workers on basic, not gross salary; COTU

Tax workers on basic, not gross salary; COTU

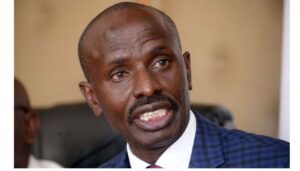

COTU Secretary General Francis Atwoli has appealed to President William Ruto to amend regulations to ensure that certain taxes, such as the housing levy, are calculated based on basic salary rather than gross salary.

Currently, the Affordable Housing Levy is imposed on employees at the rate of 1.5% of their gross salary, with employers matching the contribution by adding another 1.5% of each employee’s monthly gross pay.

Speaking during the Labour Day celebrations on May 1 at Uhuru Gardens, Atwoli argued that taxation based on gross salary is impoverishing workers.

He noted that while workers support the housing levy in principle, their hard-earned income is being drained because some levies are tied to gross pay, which includes various allowances.

“All taxes should be based on basic salary, not gross pay, so that workers can benefit from their overtime payments,” Atwoli said.

“Workers should be able to fully realise the rewards of their overtime.”

Under the current taxation regime, Kenyans’ additional earnings — including allowances and overtime — are taxed, reducing their take-home pay even further.

At the same time, Atwoli urged the president to ensure that employed Kenyans can access affordable housing through loans tied to their payslips.

MP Bashir Abdullahi forced to apologize over ‘people die all the time’ remarks

Shock as the body of a man is retrieved from septic tank in Machakos

Makau Mutua fires back at critics questioning his appointment as Ruto Senior Advisor

I will make my decisions however unpopular they are; Ruto

Cardinal Njue to skip election of new Pope

Ruto appoints Prof Makau Mutua as the Senior Advisor of Constitutional Affairs

“Kenyan workers do not have deposits; let them access affordable houses using their payslips,” Atwoli said.

He emphasised that the law should be streamlined to make it easier for workers to access loans for affordable homes.

In 2024, the Kenya Revenue Authority clarified that gross monthly salary includes basic salary and regular cash allowances such as housing, travel or commuter, and car allowances, as well as any other regular cash payments.

It excludes non-cash payments and irregular income such as leave allowance, bonuses, gratuity, pensions, severance pay, or other terminal dues and benefits.

All employees, regardless of their contract type, are required to pay the Affordable Housing Levy. However, employees paying the levy under Section 31B of the Employment Act, 2007, are not eligible for Affordable Housing Relief under Section 30A of the Income Tax Act, Cap 470.

DR Congo seeks to remove ex-President Kabila’s immunity

Government to allow workers use payslips to acquire affordable housing units

Government to hire 20,000 intern teachers in January 2026

Fred Matiang’i to make first public appearance in Gusii region on May 2

James Orengo expresses concerns over conduct of 2027 elections

What MP Ong’ondo Were said on his life being in danger

Gatundu Assistant Chief dies by suicide after allegedly drugging, sodomising two boys

Follow us