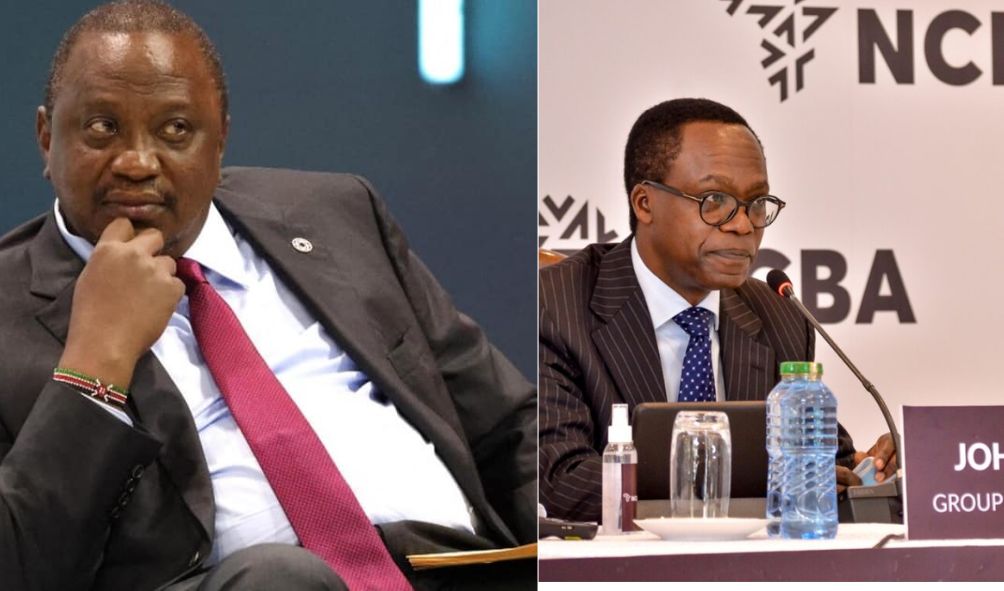

Uhuru’s NCBA bank ready to pay KSh350m tax waiver

NCBA bank ready to pay KSh350m tax waiver after tax evasion claim according to Managing Director John Gachora

NCBA bank ready to pay KSh350m tax waiver after tax evasion claim according to Managing Director John Gachora.

According to NCBA Managing Director John Gachora, if the court orders it, the lender will pay the Sh350 million tax waiver.

The MD claimed that the waiver obtained by the bank during the CBA and NIC merger was above board and that it was permitted by law.

“What I assure Kenyans is that should the court find that NCBA was not entitled to the waiver, the day the court makes that decision, the following day we will send a cheque of Sh350 million. That I can assure you,” the MD said during an interview with KTN News.

In response to allegations made by some politicians that the bank has been avoiding paying taxes to the Kenya Revenue Authority, MD Gachora stated that the lender is in compliance with tax laws.

He said the allegations were false and that the bank had received preferential treatment under the administration of former President Uhuru Kenyatta.

“In the same year that we got the waiver for sh350 million, we paid a total taxes of sh4.4 billion, more than 10 times that people were talking about,” Gachora said.

“NCBA is one of the biggest taxpayers in the country, having paid taxes amounting to Sh6.7 billion in 2021 and will fork out Sh14.3 billion in taxes for last year.”

Forget change of government before 2027-Former UDA chairman tells Raila

Ruto warned over his move to punish Uhuru, “it will backfire on you”

Azimio escalates counter strategy to frustrate Ruto’s government

Uhuru has come under attack from President William Ruto and his allies, who claim he engineered the tax exemption to benefit the bank in which the Kenyatta family still holds a sizable stake.

The combined NCBA entity was exempt from paying Sh350 million in taxes in 2019 thanks to a National Treasury exemption.

The waiver is the subject to a court case filed by Busia senator and activist Okiya Omtatah who has argued that the National Treasury effected a “secretive and opaque decision”.

Omtatah argues that the then National Treasury Cabinet Secretary Henry Rotich did not have the power to arbitrarily grant the tax waiver.

“The taxpayer will suffer great loss estimated at Sh350 million in lost tax revenues that would otherwise accrue to the public coffers,” he said in court papers.

But Gachora defended the waiver saying it was not only above board and guaranteed in law.

“People need to understand that the waiver was given to NCBA or the merging parties with over 26,000 shareholders behind the banks that were merging,” he said.

The Kenyatta family had a significant stake in CBA, while NIC Group was controlled by wealthy businessman Phillip Ndegwa.

Kenya Kwanza politicians have claimed that the former President used his position to push for the tax waiver, denying the taxman Sh350 million.

Also read,

Uhuru responds to attacks by Ruto over tax evasion claims

Law exempting Kenyatta and Moi families from paying taxes

Follow us