US slaps Kenya a default notice for Sh57bn KQ debt

US slaps Kenya a default notice for delayed payment of a KSh57.8 billion loan that the government guaranteed Kenya Airways (KQ)

US slaps Kenya a default notice for delayed payment of a KSh57.8 billion loan that the government guaranteed Kenya Airways (KQ).

A US-backed financier has issued a default notice to the Treasury for Kenya Airways’ KSh57.8 billion loan, which the government guaranteed.

The Exim Bank of the USA has submitted a default notice after Kenya failed to make loan payments on time, the Treasury Principal Secretary Chris Kiptoo told Parliament.

This demonstrates the country’s difficulties dealing with its growing public debt, whose cost maintenance is anticipated to account for more than half of anticipated State income in the fiscal year that ends in June.

The Private Export Funding Corporation (PEFCO) of the USA, Exim Bank of the USA, and the Government of Kenya all provided guarantees for KQ’s $525 million (Sh64.6 billion) loan, which it partially missed payments on.

The 89-year-old Exim Bank, which is entirely owned by the US government, offers working capital guarantees, direct loans, export credit insurance, and guarantees for commercial loans to American exporters.

According to Dr. Kiptoo, the Treasury guaranteed the loan to the financially troubled airline at a rate of Sh84 to the dollar. The dollar presently exchanges hands for Sh125.2.

“We have an outstanding balance of $462 million (Sh57.77 billion). A default notice has been issued by the guaranteed lender which is US Exim Bank which has called on the government of Kenya to pay. Now we don’t have, to say the truth, enough headroom to pay, but what is important is to pay,” Dr. Kiptoo told the committee on Public Debt and Privatisation.

Technically a call-up of the loan means that the lender can demand full repayment of the debt on fears of a borrower’s future ability to make payments.

The KQ loan was a 12-year facility initially provided by Citi Bank and JP Morgan before PEFCO took it over as Exim and Kenya government joined in as guarantors.

The airline halted payments as it ran into financial difficulty exacerbated by the Covid-19 pandemic, which led to the grounding of a large part of global air travel.

The airline stopped remittances on the guaranteed and the non-guaranteed portions of the loan, the Treasury said in an earlier report.

“Following the default,” according to the report, the cabinet gave approvals to pay the loan arrears “and the loan balance to be novated—replace an old obligation with a new one– to the government.”

Bill Gates recalls how a Kenyan farmer taught him how to hold a chicken

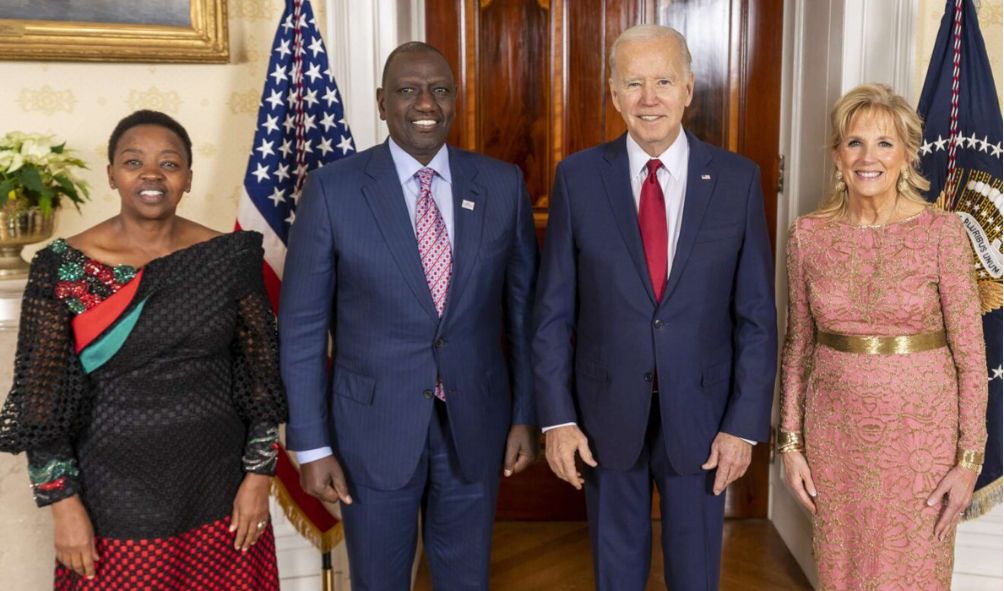

Kenya-USA completes first round of Trade and Investment Partnership

Ruto drops over 3,000km of road planned by Uhuru

The airline, which has been surviving on State bailouts since the Covid-19 pandemic, reported a KSh9.8 billion loss in August — a better performance than the Sh11.48 billion loss it recorded in the same period a year earlier.

The government in December announced it will take over Kenya Airways loans amounting to $485 million (Sh59.7 billion) that it had guaranteed the carrier.

The Treasury officials told the International Monetary Fund (IMF) that government would undertake many such takeovers of distressed loans—technically known as novation—pushing up the country’s annual debt service by Sh10 billion.

The airline has been a perennial beneficiary of State bailouts, with the carrier expected to receive another Sh35 billion in the current financial year, with some of it being used to repay its debts.

Dr. Kiptoo told MPs that the government has been undertaking KQ restructuring dubbed “Project Kifaru.”

“To date, Sh16.3 billion has been disbursed under Project Kifaru to turn around the company,” the PS told MPs before the journalists were locked out of the meeting on grounds that the KQ issue is sensitive.

Also read,

Ruto boosts Kenyatta family’s Ksh 500B Northlands City project

Parliamentary Budget Office warns Ruto over IMF reforms

Raila reveals Azimio’s growing mistrust of Ruto’s government

Follow us