No one will be spared as KRA moves tax casual workers housing levy

KRA says casual workers and board members of public and private companies will be subjected to a housing levy

KRA says casual workers and board members of public and private companies will be subjected to a housing levy.

The Kenya Revenue Authority (KRA) has said casual workers and board members of public and private firms are required to pay the affordable housing levy.

In a letter dated September 13, 2023, the taxman stated that directors of State corporations and other businesses are also required to pay the housing tax as they receive payment for providing services to their employers, just like all other employees.

“Therefore, affordable housing levy is applicable to all employees, including directors, notwithstanding their terms of engagement or contract of service,” said the KRA’s deputy commissioner for policy and tax Advisory, Esther Wahome.

The Association of Pension Trustees and Administrators of Kenya had asked KRA for clarification on whether the Affordable Housing Levy (AHL) applies to the allowances provided to board members on a quarterly basis, honoraria paid on a monthly basis, and salary paid to temporary employees.

However, the taxman says in the letter that gross monthly salary constitutes basic salary and regular cash allowances.

According to KRA, as directors’ meetings frequently occur at predetermined intervals and as a result have a certain degree of regularity, honoraria and directors’ allowances would be considered regular allowances.

Moses Kuria recounts moment he was forced to hide in Raila’s home

CS Kuria office moved amid a row with DP Gachagua

Tradey as mother, three children burn to death

Only four counties meet their own-source revenue target; Report (LIST)

“Honoraria paid on a monthly basis and director’s allowances paid on a quarterly basis for a contract of service are therefore subject to affordable housing levy. Further, salaries paid to casuals for services provided for a period of time are also subject to AHL,” said Ms Wahome in the letter.

The statutory deduction adds to the tax burden on employed Kenyans who are struggling with the rising cost of living amid a freeze on salary increases and employment by Kenyan firms.

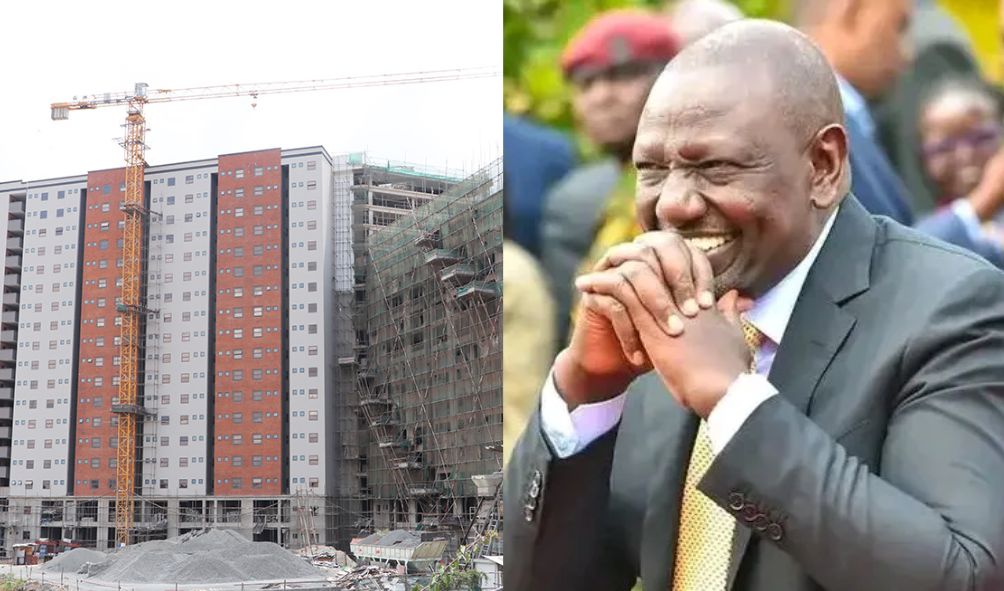

Dr Ruto’s administration wants to build houses as part of his bottom-up economic model, arguing that it will provide shelter to those living in slums and create jobs via the construction of 250,000 houses annually.

Contributions under the Housing Development Levy are expected to soar by 40.8 percent to hit Sh89 billion in the 2026/27 financial year, up from Sh63.2 billion in the current fiscal cycle.

Also read,

‘Anonymous Sudan’ hackers in the recent cyber attack in Kenya linked to Russia; Report

Government bars public workers from swapping leave days for money

Safaricom announces M-Pesa charges

Kenya opens base in Haiti ahead of police deployment

Kenya seeks partnership with China in intelligence sharing

Follow us