Government plans to introduce new deduction on hustler fund

Government plans to introduce new deduction for health insurance on hustler fund according to Co-operative CS Simon Chelugui

Government plans to introduce new deduction for health insurance on hustler fund according to Co-operative CS Simon Chelugui.

In an effort to improve health insurance to Kenyans, Co-operative Cabinet Secretary Simon Chelugui on Thursday, April 13 unveiled intentions to add more deductions to the hustler fund.

The National Health Insurance Fund (NHIF) had approached the ministry to have debtors contribute to their insurance through the fund, the CS said at a meeting in Nairobi County.

According to the CS, the proposed deductions stood at Ksh17, with further discussions being held.

The CS stated that the decision will help many Kenyans and business owners who occasionally had to spend a lot of money on medical care.

He noted that the deductions would also cover those with children.

“Over 10 per cent of the population borrows from the Hustler Fund daily. 19.7 million Kenyans have borrowed Ksh26 Billion and have repaid Ksh16 billion, which is 62 per cent.

“NHIF is engaging with us with the view of also taking out Ksh17 daily from the hustler and putting it in their health insurance and this amount will assure them of medical and accident expenses,” the CS stated.

Following the revelation, several Kenyans, including representatives of the SMEs, backed the planned deductions as they noted that many Kenyans either lacked health insurance or were inconsistent in making their monthly payments.

“If I fall sick today, I have to close my shop and use whatever I have to seek treatment. This also happens when my family also fall sick.

“Sickness is the major disruptor of Small and medium-sized enterprises (SMEs) and the greatest driver of poverty,” one of the representatives stated.

EPRA issues statement on lowering fuel prices after Ruto-Saudi oil deal

Leaked UN files reveal Antonio Guterres doesn’t trust Ruto

Gulf companies lock out National Oil out of UAE fuel deal

Kenya inks deal with Saudi Arabia to import fuel on credit

Currently, Kenyans part way with 5 per cent of their hustler fund, which goes to savings and pensions.

The deductions were introduced following the recommendations of President William Ruto, who noted that Kenyans needed to create a savings culture for their future – a key plan in the Kenya Kwanza manifesto.

Nationwide health insurance was also among the key agendas of the Ruto administration.

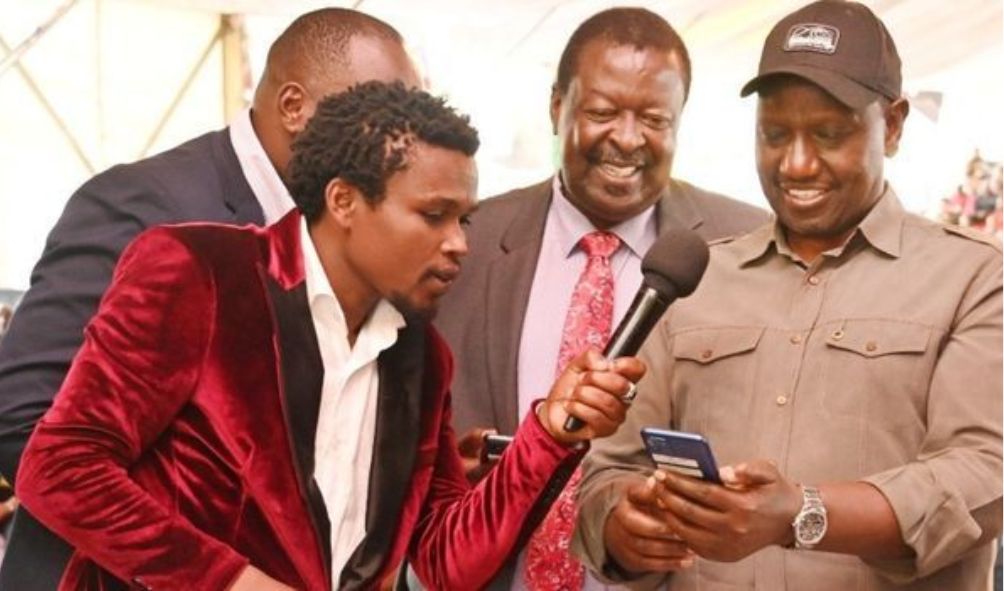

Notably, Ruto recently praised the Chelugui for the Hustler Fund’s progress, noting the over 15 million Kenyans who had benefitted from the loans.

“I must commend the ministry responsible for Hustler Fund, in a record 90 days we had a product that seven million Kenyans are borrowing every day and paying,” he stated.

In February 2023, the President pledged to revamp NHIF to cover all medical conditions. The government also mulled reducing NHIF deductions from Ksh500 to Ksh300 to increase uptake.

“It will be possible later this year to pay Ksh300 and keep the cover. We are in discussion with stakeholders in the sector to actualise the commitment I made to the people of Kenya to make NHIF contributions affordable for all,” President Ruto stated on April 4, 2023, during the Social Protection Conference event.

Also read,

Looming fuel prices hike as oil producers (OPEC) announced plans to cut output

US-Kenya trade talks stalls over new demands

Why Ruto is losing in Kenya-US trade talks, experts

World Bank approves USD390m financing to Kenya

Follow us