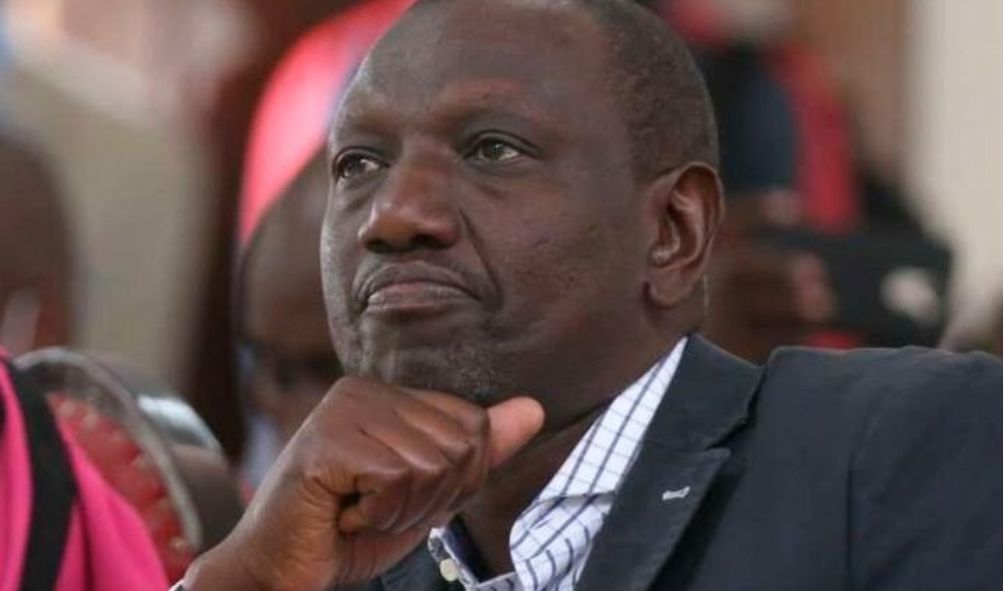

Investors unwilling to lend Ruto’s government money

Investors unwilling to lend Ruto's government money amid a cash squeeze that has seen the State delay payment of civil service salaries

Investors unwilling to lend Ruto’s government money amid a cash squeeze that has seen the State delay payment of civil service salaries.

In response to a drive for higher interest rates and a liquidity crunch that has resulted in the State delaying the payment of civil sector salaries, investors are reluctant to lend the government billions of shillings.

Only one in four Treasury bonds offered this year have met their target, with the latest issue raising a measly Sh3.57 billion against a target of Sh20 billion, reflecting a performance of 17.85 percent.

Due to the cash shortage, investors are predicting higher rates, which is driving many to postpone investing in longer-term securities like bonds in the hopes that the rising returns have not reached their peak.

Instead, as they adopt a wait-and-see approach regarding the direction of returns in the bond market, they have chosen to place their money in the shorter 91-day Treasury bill, which has been oversubscribed by as much as 643%.

In comparison to yields of between 11.2 percent and 13.9 percent during the same period last year, interest rates on bonds have fluctuated between 12.9 percent and 14.4 percent this year.

After averaging 7.8 percent in June of last year, the 91-day T-bill reached double digits for the first time since February 2016 at 10.004 percent.

Investors bid some Sh25.731 billion versus just Sh4 billion on offer, resulting in a performance rate of 643.29 percent last week.

The apathy in the bond market has worsened the State’s cash squeeze caused by massive interest payments for Kenya’s mounting public debt.

“We are in a rising interest rate environment and as such, many would want to hedge against duration risks and hence the low subscriptions seen on Treasury bonds,” analysts at Sterling Capital said.

The analysts also linked the under subscription to investors seeking returns above the sky-high inflation and the knowledge that the State could up its appetite to raise cash from the domestic market, bumping returns from Treasury bonds.

Treasury data for the eight months to February reveal the impact of depressed domestic borrowing on State spending and the resulting cash crunch.

Domestic borrowing inclusive of debt rollovers plunged by 47.2 percent in the eight months to Sh333.3 billion compared to Sh631.1 billion raised in the same period a year earlier.

China responds to claims of setting debt trap for Kenya after Ruto turned to US

KRA issues clarification on revenue collection shortfall

State increases monthly pension for former First Lady Mama Ngina Kenyatta

Tough times ahead as Treasury warns civil servants of more salary delays

Churchill Ogutu, an economist at IC Asset Managers, said government spending will be depressed in the absence of further budget cuts as the trajectory of domestic borrowing remains lean for the remainder of the fiscal year.

“Reduced domestic borrowing will constrain fiscal operations in the absence of a second supplementary budget that brings down the budget expenditure to a more sustainable level. It will be a tough balancing act in the remainder of the fiscal year,” he noted.

Total revenues over the eight-month period trailed last year’s tally by some Sh27 billion or 1.45 as improved tax and higher foreign borrowing offset the decline from domestic borrowing.

Rising inflation is forcing investors to put pressure on the State in search of better real returns. Kenya’s inflation remained unchanged at 9.2 percent in March on soaring food and fuel prices.

Inflation has remained outside the preferred government range of 2.5-7.5 percent since June last year.

The International Monetary Fund Tuesday said Kenya’s average inflation this year will stand at 7.8 percent.

Also read,

Ruto foreign travel spending triples in the first half than that of his predecessor

World Bank report ranks Kenya among top performing economies

Kenya’s external debt increases by KSh344bn to about KSh5.03 trillion

Follow us