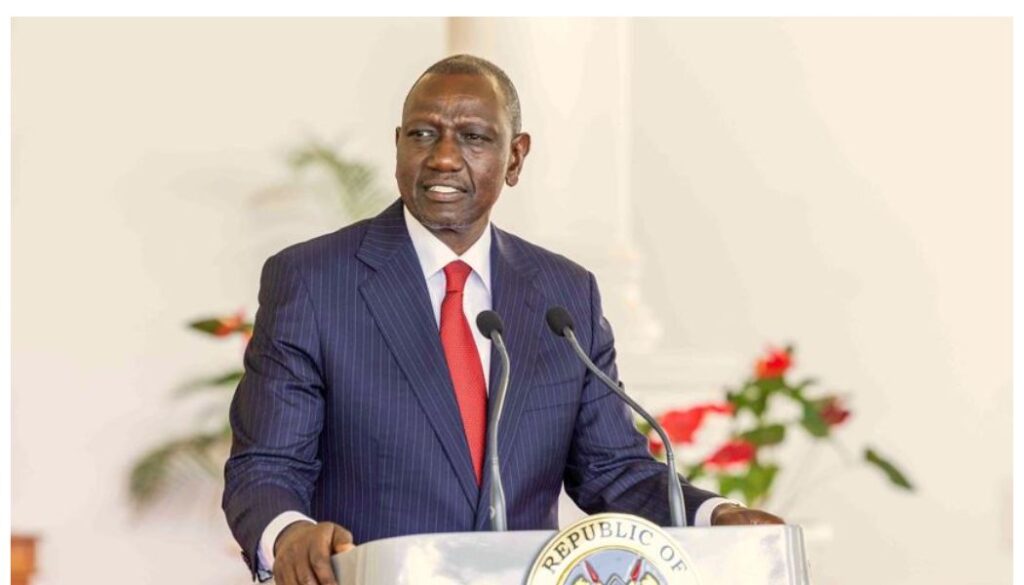

Kenya now Africa’s sixth largest economy because of difficult decisions I made – Ruto

Ruto has reiterated that his prudent decisions on debt repayment have enabled Kenya to recover significantly and become one of Africa's top economic performers.

President William Ruto has reiterated that his prudent decisions on debt repayment have enabled Kenya to recover significantly and become one of Africa’s top economic performers.

Speaking in State House while receiving the Jukwaa la Usalama report on Tuesday, President Ruto maintained that Kenya was ailing from ballooning external debts, which threatened a default.

He intimated that he had to make “painful decisions” to help the nation repay its debts, claiming that Kenya avoided default despite being part of six African countries that were predicted to default.

“Today I can confidently tell you our economy is in sound footing. Had I not made those decisions we would be among the countries that defaulted their debts,” he noted.

“Foreign reserves had reduced to $5.7 billion and everybody believed Kenya will not be able to pay its debt. I sat in an office called number 6 with some people and agreed that we cannot be the country to default and I had to make very difficult decisions.”

He added that his decisions reduced Kenya’s inflation significantly and increased dollar reserves to $12.1 billion, the highest level in national history.

“Inflation has gone from 9.6 to 4.6, the dollar has recovered from Ksh.167 to Ksh.129,” he said adding “…the long-term benefits outweigh the short-term benefits.”

Ministry of Education announces scholarships for needy students joining senior school in 2026

New details emerge over the death of Daystar University student

Cameroonian opposition figure Anicet Ekane dies in detention

Government vows a crackdown on political goons

Three police reservists shot dead

In its October 2025 World Economic Outlook (WEO), the International Monetary Fund (IMF) projected 2026 GDP for Africa’s largest economies, with Kenya ranking sixth.

According to the data, Kenya’s GDP in current dollars ($1=Ksh.129) is expected to be $140 billion (Ksh18 trillion), up from $136 billion (Ksh.17.5 trillion) in 2025.

Standard & Poor’s, which provides financial information, analytics, and credit ratings, also upgraded Kenya’s long-term sovereign credit rating to ‘B’ from ‘B-‘.

“The outlook is stable. At the same time, we affirmed our ‘B’ short-term sovereign credit rating on Kenya,” S&P said in its August report.

The global agency said that Kenya’s near-term external liquidity risks have receded and its external data revisions, coupled with strong performances in coffee exports and diaspora remittances, supported a narrowing of Kenya’s current account deficit.

Additionally, it observed that Kenya’s $1.5 billion (Ksh.193.8B) Eurobond issuance and concurrent buy-back operation in February 2025 helped lower Eurobond principal repayments to $108 million (Ksh.13.9B) annually over 2025-2027, from $300 (Ksh.38.7B) million previously.

Chwele/Kabuchai Ward MCA-elect Eric Wekesa summoned by DCI

KNH advertises several job opportunities; How to apply

Kalonzo dismisses claims Wiper cut secret deal to hand Nairobi seats to Gachagua

EACC arrests labour ministry officials at JKIA for extorting travel agents

State House official confronts drunk driver in a heated exchange

Follow us