Kenyans struggling to meet their debt obligations; Report

Parliamentary Budget Office report reveals that struggling to meet their debt obligations in repaying loans

Parliamentary Budget Office report reveals that struggling to meet their debt obligations in repaying loans.

According to the report, lenders may face challenges in recovering money loaned out to Kenyans, which may impact their financial health.

“There may be a need to restructure the non-performing loans/debt resulting in an additional burden on borrowers in revised interest rates,” the report said.

The report ascribed Kenyan borrowers’ difficulties to the depreciating shilling, which has caused a sluggish business environment, and the high cost of borrowing as a result of the tightening of monetary policy.

The high cost of fuel, unpaid bills, and recent tax changes that have decreased household disposable income and purchasing power were also cited by the research as contributing factors to the predicament.

“Although credit to the private sector has remained stable, the rate of non-performing loans has risen sharply,” it said.

NYS announces Job opportunities for its graduates in the UK, Link to apply

Police officer found dead within station compound

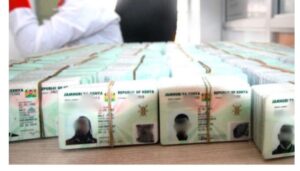

Government responds to reports of planting electronic chips on children ongoing Digital ID rollout

“I regret campaigning and voting for Ruto,” UDA MP (VIDEO)

Miguna spells doom for Ruto over the housing levy “You can’t regularize that which is nullified”

Ruto’s cabinet secretaries unbecoming; Senate

It further stated that from 13.3% in December 2022 to a 16-year high of 15% in August 2023, the stock of non-performing loans has increased dramatically.

The report also noted that the Kenyan Shilling has depreciated against major global and regional currencies.

“The shilling has lost 23 per cent to the US Dollar, 38 per cent to the Sterling Pound, 33 per cent to the Euro, 21 per cent to the Uganda Shilling and 12 per cent to the Tanzania Shilling between September 2022 and September 2023,” the report shows.

It added that the pressure on the shilling is fuelled by sustained demand for imports, subdued recovery in capital inflows as foreign interest rates remain elevated, enhanced dollar demand, and persistent strengthening of the US dollar globally.

“Domestically, the cost of living remains a key concern as prices of food, fuel, energy and other inputs remain elevated amid the rising cost of debt service, tight fiscal space, foreign exchange liquidity challenges, depreciation of the shilling and constrained business environment,” the report said.

Also read,

Ruto secures another loan of Ksh 12.3b from AfDB

Raila calls on all employers to stop remitting housing levy

Police officer accidentally shoots self to death inside station

IMF behind the privatization of state parastatals; Report

US firm blocks Kenyan companies from global index

Follow us