KRA introduces new tax compliance certificate requirements

The Kenya Revenue Authority (KRA) has announced that it has enhanced the Tax Compliance Certificate (TCC) application process.

The Kenya Revenue Authority (KRA) has announced that it has enhanced the Tax Compliance Certificate (TCC) application process.

In a notice on Friday, October 24, the authority said the application process will now include compliance with the electronic Tax Invoice Management System (eTIMS) and Tax Invoice Management System (TIMS).

The taxman noted that the requirement applies to all non-individual entities and individuals with income other than employment.

“Kenya Revenue Authority (KRA) notifies the public that it has enhanced the Tax Compliance Certificate (TCC) application process to include compliance with eTIMS/TIMS for non-individual entities and individuals with income other than employment income,” read the notice in part.

Taxpayers seeking a TCC must now ensure they are compliant with eTIMS/TIMS registration for persons in business, have filed tax returns on or before the due date, and settle any outstanding tax liabilities or enter an approved payment plan.

They must also be VAT compliant, including those under the VAT special table status.

JSC shortlists 100 candidates for High Court judge positions (LIST)

IEBC clarifies notice declaring 2 UDA aspirants as unopposed winners

Police officer shot dead in an ambush by Al-Shabaab in Dagahaley, Wajir

Ruto announces new plan to train, support single mothers

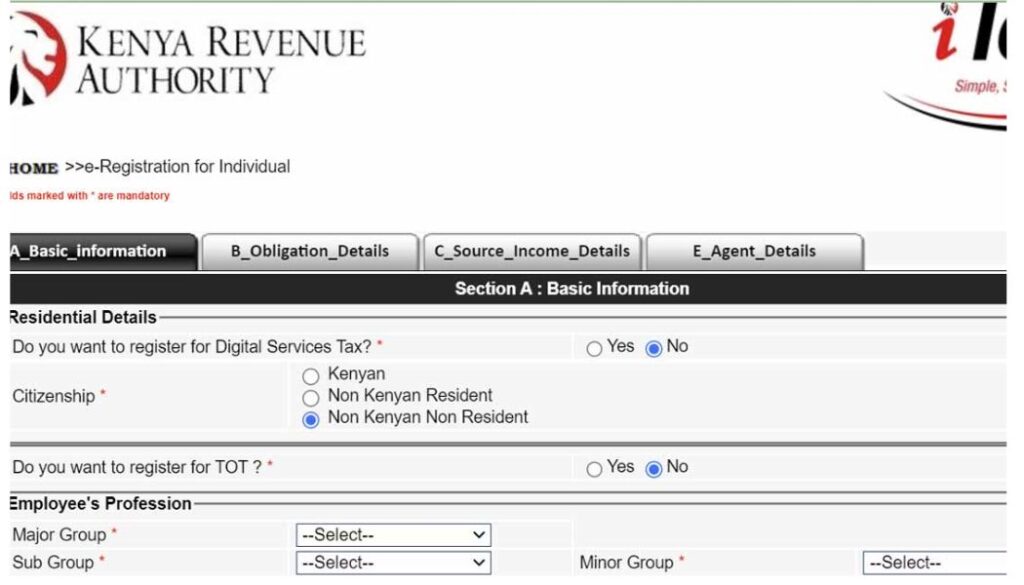

Further, the authority said taxpayers can apply for the TCC through the iTax platform and check validity using the online certificate checker.

“Taxpayers can apply for a TCC through the iTax platform. They can check the validity of a TCC using the Certificate Checker on https://itax.kra.go.ke/KRA-Portal/,” KRA stated.

Additionally, KRA said any challenges arising from the new requirements will be addressed on a case-by-case basis.

“Any challenges encountered during implementation will be addressed on a case-by-case basis, in line with the existing legal framework,” the authority added.

The notice comes weeks after the authority announced that all consignments imported into the country will be required to have a Certificate of Origin (COO).

In a public notice on September 23, KRA said the directive is anchored in Section 44A of the Tax Procedures Act, CAP. 469B, as amended by the Finance Act, 2025.

The authority noted that importers and customs clearing agents will now be required to provide a COO issued by a competent authority in the country of export effective October 1, 2025.

UDA proposes establishment of Raila Odinga School of Government at UoN

University lecturers dismiss SRC’s Sh3.1 billion offer for 2025–2029 CBA

Petition filed to have Raila Odinga statue erected in Parliament

Veteran journalist and State House MC Sammy Lui is dead

Follow us