KRA sets date for commencement of all nil tax returns filings

KRA sets date for commencement of all nil tax returns filings

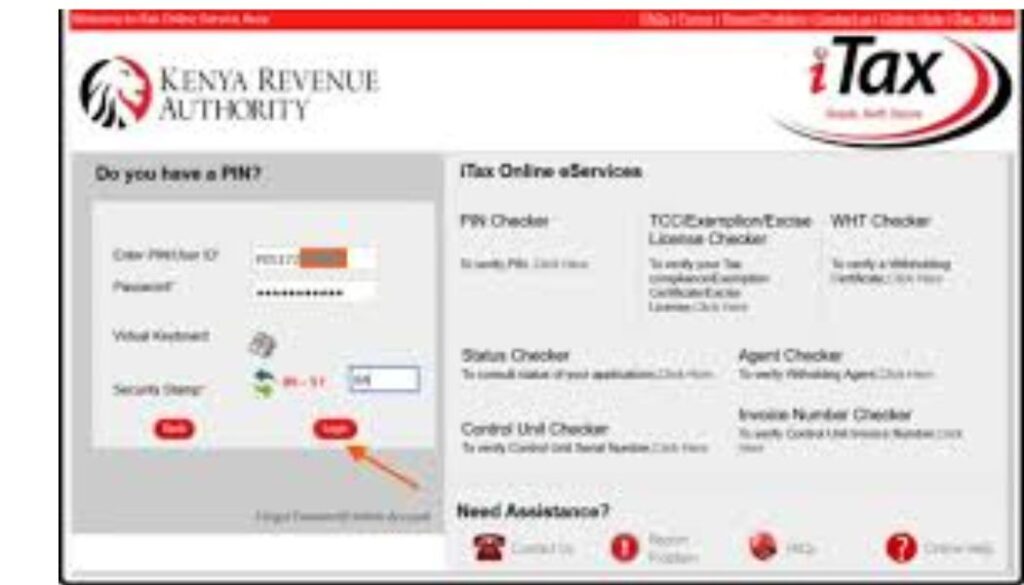

The Kenya Revenue Authority (KRA) has announced that the nil filing option for annual income tax returns will be open from March 31, 2026, following the conclusion of ongoing system validations.

In a notice on Friday, February 20, KRA revealed that it had suspended the nil filing option for the 2025 tax return year amid concerns that many taxpayers were incorrectly declaring zero income.

According to the Authority, the move follows a system review that established widespread misuse of the nil return option on the iTax system.

KRA emphasised that only taxpayers who genuinely earned no income last year will be eligible to file nil returns once the validation process is completed and the option is reinstated on March 31, 2026.

“Nil filing option will be available to eligible filers with effect from March 31, 2026, after the conclusion of validations,” the taxman announced.

KRA noted that some taxpayers had initially logged into the iTax system and filed returns indicating they ‘earned zero’ despite receiving income through salaries, side hustles, freelance work and rental income.

MPs order release of all withheld school certificates

Opposition moves to privately prosecute 12 police officers, 2 MPs over Watima attack

Sifuna hits back at CS Murkomen over Kitengela rally saga

Murkomen vows to deal with Gachagua

Former South Korea President Yoon sentenced to life imprisonment

The authority warned that Nil declarations despite earning an income undermine tax compliance, with such individuals urged to fully declare their income for the past year.

“Dear Nil Filer, we see you. You logged into iTax last year and submitted a return that said ‘I earned zero’ because you thought you had nothing to declare,” KRA posed.

Adding, “Here is the truth. If you earned anything in 2025, salary, side hustle, freelance gig, rent, or business income – you weren’t supposed to file nil.”

The latest update comes just two weeks after the Authority announced the introduction of a phased tax filing approach aimed at making tax filing easier, faster, and more personalised for millions of taxpayers.

According to KRA, the changes are designed to end the last-minute rush that it claimed often overwhelms taxpayers and the iTax system every year.

KRA disclosed that the new system will ensure that taxpayers receive the right information at the right time, rather than generic instructions.

Under the new approach, taxpayers will be grouped based on income complexity instead of everyone filing at the same time. KRA said it will send SMS and email notifications to guide taxpayers on when and how to file.

Charles Kanjama elected new LSK President with 3,728 votes

Court bars UDA aspirant in sex scandal from holding public office

Russia terms reports of Kenyans in Ukraine war as misleading propaganda

Gachagua hits out at Ruto gov’t over Githurai demolitions

President Ruto assents three key bills to advance national development

Follow us