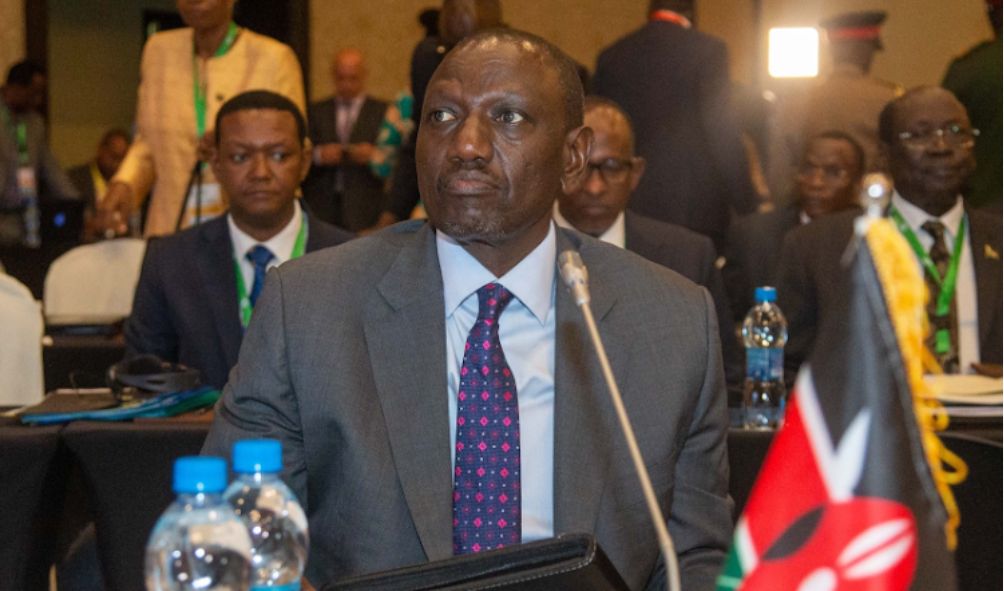

Ruto plots new taxes if Finance Act backfires in court

President Ruto plots a backup plan of new taxes in the event the Finance Act 2023 cripples in the courts

President Ruto plots a backup plan of new taxes in the event the Finance Act 2023 cripples in the courts.

In the event that the High Court strikes down the Finance Act of 2023, President William Ruto’s administration has planned a new set of taxes, including a road tax, to be implemented in October.

The Treasury has disclosed to the International Monetary Fund (IMF) that it is planning new taxes, such as an excise tax and value-added tax (VAT) measures, as a backup to fund the Sh3.68 trillion budget in the event that the currently suspended tax-raising measures run into legal trouble.

A motor vehicle circulation tax is a form of road tax paid by motorists to use public roads.

It can be calculated based on several factors, including the value of the vehicle, the engine, and seating capacities.

The Treasury has committed to submit to Parliament “a package of legislative changes” by the end of October to ensure the government hits the Sh2.57 trillion ordinary revenue target in the current financial year and avoid falling further into debt.

“The authorities stand ready to adopt contingency plans that could include new excise and value-added tax (VAT) measures. They intend to submit to Parliament these contingency measures by end-October 2023 to support confidence in fiscal consolidation and the continued reduction of Kenya’s debt vulnerabilities,” says the IMF.

“Any tax revenue shortfall relative to programme targets will be compensated for by taking additional tax policy measures”.

The establishment of a motor vehicle circulation tax and the decrease of the tax exemption on interest income are just a couple of the adjustments listed by the Treasury.

The reforms, according to the Treasury, could include streamlining the VAT apportionment ratio of allowable inputs VAT on exempt supplies to align it with international practices and reducing VAT exemptions by the end of this month.

Another Azimio MP arrested by plain-clothed police while refueling

UK King Charles issues concerns over ongoing protests in Kenya

Police officer arrested for allegedly joining Azimio protests

US remains non-committal on free trade deal with Kenya

Because of the Treasury’s commitment to the IMF, Kenyans may not have a way to avoid the impending tax agony, which includes a doubled fuel VAT of 16 percent.

The disclosures come against the backdrop of a new wave of street protests over the high cost of living and unpopular taxes that disrupted business activities in major towns in Kenya.

The IMF has asked the Ruto administration to stick to its taxation measures and not be moved by the street protests.

The High Court last month suspended the implementation of the Finance Act and referred the matter to the Supreme Court but the Energy and Petroleum Regulatory Authority (Epra) disregarded this and applied a 16 percent VAT in its review of prices.

Chief Justice Martha Koome has appointed a three-judge bench to hear the case challenging the implementation of the Finance Act, 2023.

Also read,

Today is the final, Raila provides an update on protests

IMF predicts Kenya’s forex reserves to remain under pressure

Raila reveals why he has not been attending protests

Taskforce set up to review Kenya’s fuel prices, IMF

Government meets foreign diplomats, warns them to respect Kenya’s political democracy

Follow us