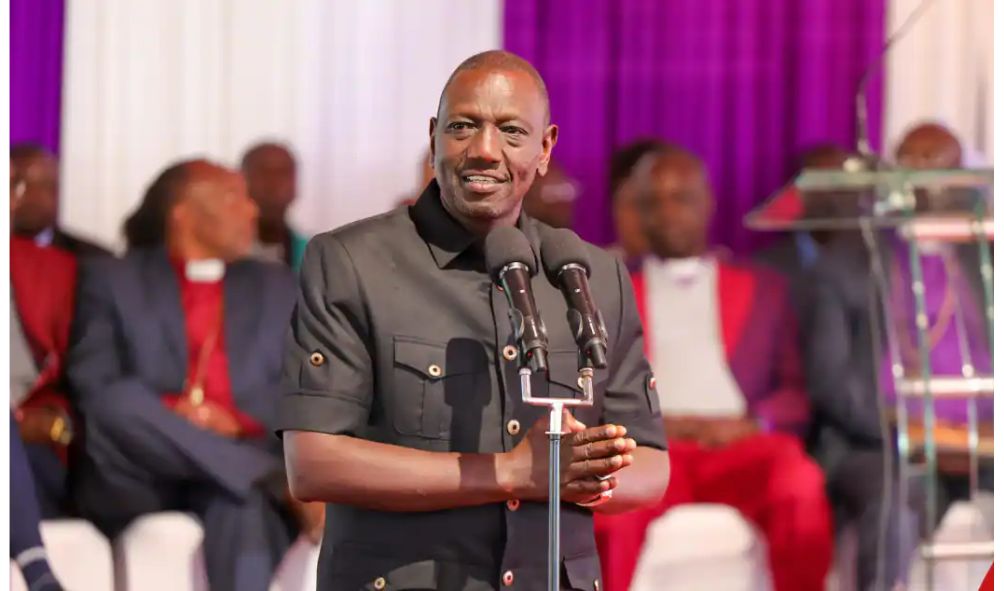

“There is no single nation that has been destroyed by taxes”- Ruto says as he vows to continue taxing Kenyans

President William Ruto insists his administration will continue taxing Kenyans to get the country out of the debt hole

President William Ruto insists his administration will continue taxing Kenyans to get the country out of the debt hole.

Speaking during a burial ceremony in Njabini, Nyandarua county on Tuesday, January 2, Ruto emphasized that taxation is the only way to lift Kenya out of its debt burden and foster economic stability.

He underscored the importance of generating revenue to fund essential government programmes and services despite stiff opposition from Kenyans who feel overtaxed.

Further, Ruto defended the introduction of a raft of taxes under the Finance Act 2023, arguing that taxes helped nations progress.

The president explained that taxes were crucial in facilitating debt repayment, noting that he wouldn’t allow the country to default on its obligations.

“Many nations have been destroyed by debt, but there is no single nation that has been destroyed by taxes. In fact, many progressive countries have been built by taxes and that is where we need to go,” he said.

Police officer shoots self in mouth

Uhuru ally Pauline Njoroge among Commonwealth Expert Team to observe elections in Bangladesh

Ruto goes after Judiciary over claims of sabotaging government projects

Government disburses funds for Inua Jamii beneficiaries

Chaos as arrested Maina Njenga followers break into song inside Nyeri station

His comments come amid criticism from Kenyans over a raft of new taxes introduced by the government.

Meanwhile, the last set of laws outlined in the Finance Act 2023 took effect beginning January 1, 2024.

One of the taxes effected on January 1 was the advance tax rate applicable to vans, pick-ups, trucks, prime movers, trailers, and lorries.

Small cars, such as saloons, will also pay a monthly tax of KSh 160 per passenger or KSh 5,000 annually from the current KSh 2,400.

At the same time, the National Treasury plans to harmonize the rental income tax rate with the corporate income tax rate to facilitate compliance.

Also read,

Former Uhuru CS Najib Balala faces another arrest

Storm brewing as Somalia rejects port deal between Ethiopia and Somaliland

PSC releases names of 8,610 interns appointed for government jobs (LIST)

Government announces nursing jobs in Saudi Arabia; Qualifications and How to apply

Daddy Owen confirms First daughter Charlene Ruto visit to his rural home (PHOTOS)

Uganda sues Kenya at the East African Court of Justice

Follow us