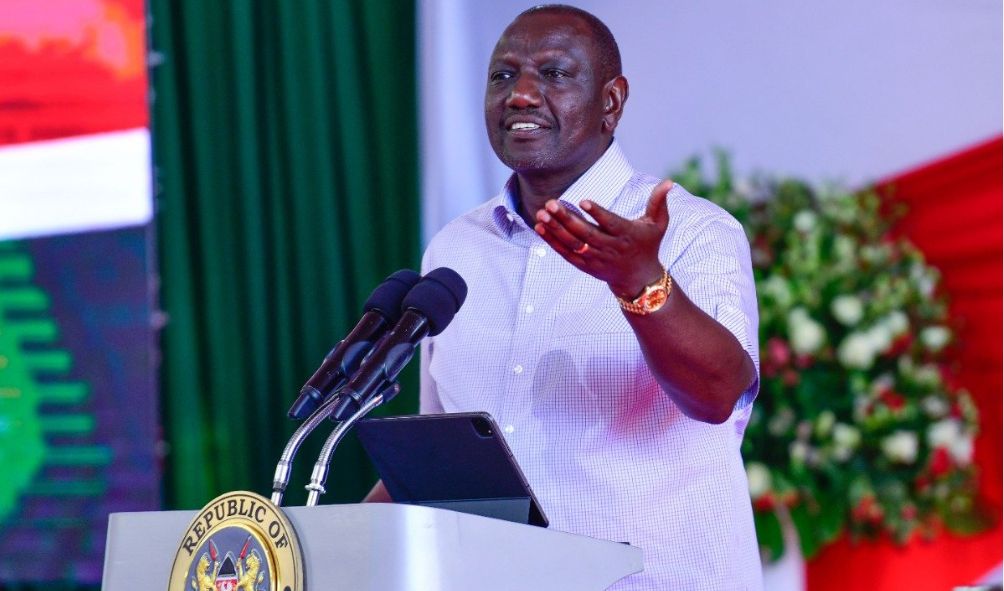

800,000 Kenyans default on Hustler fund with Ruto seeking to increase loan limit

Ruto seeking to increase the Hustler fund loan limit for 6 million Kenyans despite some 800,000 Kenyans defaulting

Ruto seeking to increase the Hustler fund loan limit for 6 million Kenyans despite some 800,000 Kenyans defaulting.

At least 800,000 Kenyans are behind payment of the Hustler fund loans.

President William Ruto on Friday said that the defaulters were behind schedule in terms of repaying the loan.

“About 800, 000 are behind schedule in payment but it is my hope that they will refund to be able to pay more,” he said.

Giving an update on the Hustler fund, Ruto said that up to February 3, 2023, 18 million Kenyans have registered with the Hustler Fund.

The Hustler Fund is specifically designed to support small-scale traders in the country.

It comprises four products: personal, micro business, SME, and start-up loans.

President Ruto had warned borrowers against defaulting with the State issuing strict measures to curb the same.

Meanwhile, President Ruto announced that six million Kenyans, who have been regularly borrowing and repaying their hustler loans on time, will have their limits enhanced.

The President said the higher loan limits will take effect from Saturday, even as he urged more Kenyans to keep their hustler loan accounts active.

Hustler fund to be increased every month, Ruto

Hustler fund loan limit to be reviewed

Government warns ‘Hustler’ defaulting Hustler Fund loans

The President announced on Friday that six million had been identified from the 14.2 million Kenyans who are servicing their loans properly.

Ruto said the majority will have their loan limits doubled while others will access 80 percent more than what they have been borrowing.

“We will from tomorrow(Saturday) increase the limit of borrowers on the hustler fund,” he said.

The President announced that the credit limits will be reviewed after every four months.

Ruto said from this month, every borrower will be assigned a financial grade based on the borrowing and repayment record.

“It will tell you what will give you a good grade,” he said.

The President spoke during the 50th anniversary of the National Police Sacco.

Also read,

Uhuru Kenyatta puts up Media Max for sale amid tax evasion claims

Uhuru’s NCBA bank ready to pay KSh350m tax waiver

Law exempting Kenyatta and Moi families from paying taxes

Follow us