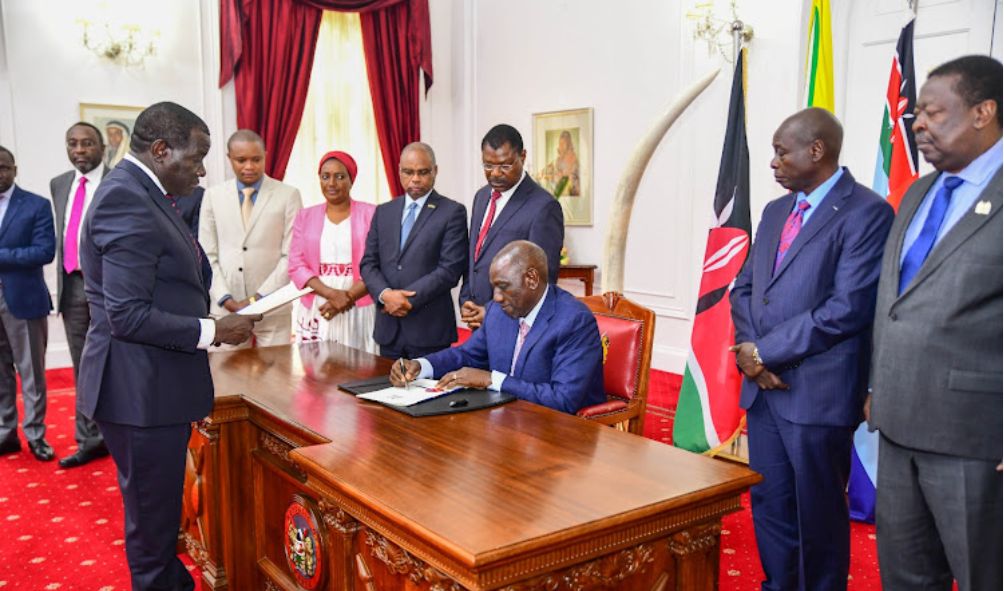

Parliament moves to change policy on the implementation of Ruto new taxes

Parliament to make it mandatory to have a complete impact assessment on the implementation of any newly proposed taxes

Parliament to make it mandatory to have a complete impact assessment on the implementation of any newly proposed taxes.

Parliamentarians are currently pressing for changes to Kenya’s tax system that would require any newly proposed taxes to undergo a thorough impact assessment.

The proposal is made in response to reports that the Finance Act of 2023’s implementation was the reason behind the job losses that Kenyans experienced in the past year.

This development is now forcing the National Assembly to make a U-turn on some of the tax proposals and how new tax implementation will be undertaken in the future.

Kenya Tax Authority (KRA) missed the quarter-one target of Sh665.9 billion despite stepping up tax collection efforts; the organization recorded a Sh79 billion deficit.

Furthermore, if the current patterns continue, a report by the Parliamentary Budget Office warns that the government will miss its target for tax collection by Sh300 billion.

The National Assembly’s Finance Committee’s report on the draft National Tax Policy (NTP) included proposals from MPs for revisions to several tax categories, including income tax, value-added tax, excise duty, customs, and the Miscellaneous Fees & Levies Act.

Atwoli calls out Kenyans complaining over high taxes cost of living

Mother throws 8 month-old-baby in Indian Ocean

Government releases Sh3.9 billion scholarship for first-year university students

List of leading counties in new HIV infections with 1.4million Kenyans infected

Parliament Finance Committee is pushing for an efficient funding structure that will ensure settlement of approved tax refunds is done within six months.

In an effort to provide certainty and predictability of the local business environment, the committee recommended that local manufacturers be exempted from new levies for up to five years.

“The committee having considered the proposed National Tax policy and submission from members recommends that levy/charge levied to support and protect the local manufacturing and investment sector remains unchanged for at least five (5) years to allow growth of those sectors,” reads the report.

It continued: “Any imposition of a levy/charge be preceded by a comprehensively undertaken economic impact assessment before approval or implementation.”

Under the income tax band, the MPs want the government to set a cap on the amount of personal income that can be taxed.

Also read,

KEBS declares multi-billion cooking oil imported by Ruto administration unfit for human consumption

Ruto to warn UDA MPs opposing his government agenda

Police found dead with his body mutilated after leaving the station for a nearby shop

Raila to consider vying for president in 2027 elections

Ruto’s economic advisor explains why UDA MPs are turning against the president

Follow us