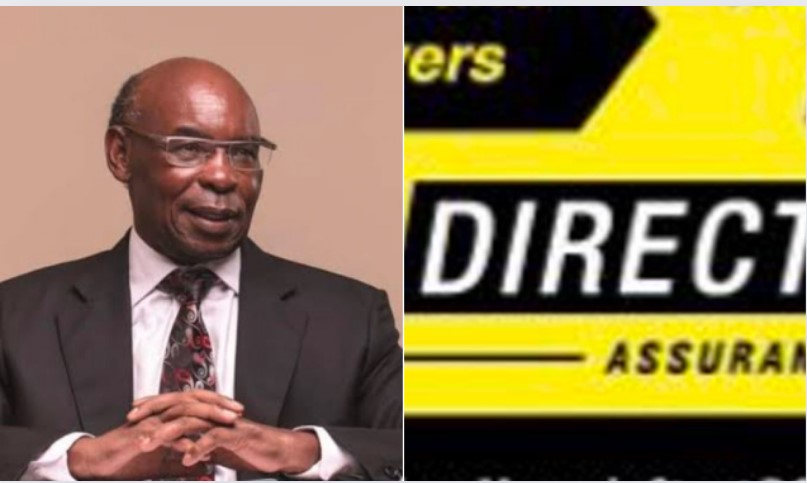

S.K. Macharia shuts down Directline Assurance Company, fires all employees

Chairperson of Royal Credit Limited SK Macharia announces the immediate closure of Directline Assurance Company

Chairperson of Royal Credit Limited SK Macharia announces the immediate closure of Directline Assurance Company.

In a significant development within the insurance sector, Royal Credit Company has announced the immediate closure of Directline Assurance Company.

In a statement on Monday by the Chairperson of Royal Credit Limited SK Macharia, he said the insurance company was terminating all its employee’s contracts.

Macharia also declared the dissolution of the company’s Board of Directors.

“The board of directors of Directline has been dissolved and all the assets taken over by Royal Credit Ltd. All employees have been dismissed, and Directline will no longer issue insurance services,” Macharia said.

Macharia explained that the closure was prompted by the Insurance Regulatory Authority (IRA)’s decision to shut down all Directline bank accounts.

He attributed the company’s downfall to the misappropriation of over Sh7 billion by the former directors of Directline, a matter he claims the IRA failed to address adequately.

As a result, the staff members’ contracts were terminated immediately and all assets owned by Directline Assurance will be taken over by Royal Credit Limited.

The company has also suspended all insurance services.

The closure of Directline Assurance marks a significant shift in the insurance landscape, affecting numerous policyholders and stakeholders.

Royal Credit’s takeover of Directline’s assets aims to mitigate some of the financial impacts, although the immediate cessation of all insurance services provided by Directline Assurance has left many in uncertainty.

Directline Assurance has been a notable player in Kenya’s insurance market, particularly known for its motor insurance products.

In June 2023, Directline closed the year with Sh1.66 billion in gross premiums from motor commercial PSV insurance, capturing a 60.79% market share, as per the Insurance Regulatory Authority.

It was followed by Xplico with 9.7%, Africa Merchant Assurance with 9.26%, Invesco with 9.01%, and GA Insurance with 6.94%.

Malawi Vice President Saulos Klaus confirmed dead after plane crash

Ruto responds to Uhuru Kenyatta on being denied office budget allocation

Blow to students joining universities in September

Ruto and Gachagua score D in latest government performance report

KUCCPS opens applications for KMTC 2024 intake; How to apply

Uhuru Kenyatta rubbishes government claims on office funding

In the first half of 2023, Directline experienced underwriting losses of Sh576.22 million for insuring matatus and buses, surpassing the Sh311.88 million loss recorded for the entire year of 2022.

The sudden closure raises questions about the stability and regulatory oversight within the industry.

Dr. Macharia’s criticism of the IRA for not taking timely action against the former directors highlights potential gaps in regulatory enforcement that may have allowed financial mismanagement to go unchecked.

The Insurance Regulatory Authority has not yet responded publicly to Dr. Macharia’s allegations or the closure of Directline Assurance.

Directline joined the Kenyan market in November 2005 as a motor vehicle insurance company.

The company provided insurance cover for Public Service Vehicles (PSV).

Also read,

Senior NYS Chief Inspector found dead in his house after going missing for four days

Francis Atwoli re-elected to the international body for a fifth time

Isaac Rutto appointed as JSC Vice Chairperson

Military plane carrying Malawi’s vice president has gone missing, search is underway

Ruto signs Division of Revenue, Supplementary Appropriation Bills into law

State House intimidating staff at Uhuru Kenyatta Office; Kanze Dena claims

Follow us