CBK increase loan rates, the highest in seven years

CBK (Central Bank of Kenya) increases base lending rates setting the tone for the highest loan rate in seven years

CBK (Central Bank of Kenya) increases base lending rates setting the tone for the highest loan rate in seven years.

Kenyans will now start paying more for their loans after the Central Bank of Kenya increased the central bank’s base lending rate to 10.5% from 9.5%.

The move, which sets the tone of the new CBK leadership, has ushered in a new era of expensive bank loans and will further erode the spending power of Kenyan consumers.

Higher interest rates mean consumers will spend more to service their loans.

Besides bank borrowers, the higher rates will also hit ordinary consumers in the form of more expensive goods on the shelves.

According to the CBK’s Monitory Policy Committee, the increase was necessitated by a hike in inflation, and a gloomy outlook on inflation in the coming months.

An elevated global risk also informed the decision.

The rate of increase was also the highest in nearly eight years since July of 2015 when the CBR rose by 150 basis points (1.5 percent).

The higher reset of the benchmark interest rate, which seeks to trim demand for goods and services in the economy by limiting money in supply, comes barely a month since the CBK, under the previous leadership of Dr. Patrick Njoroge, left interest rates unchanged on improved inflation expectations.

Concerns over increasing Alshabaab attacks as Ruto suggests prolonged KDF stay in Somalia

Ruto promises to ban imported shoes

Uganda, Tanzania overtake Kenya in latest IMF ranking

Revealed! How Ruto manipulated Azimio MPs to back finance bill

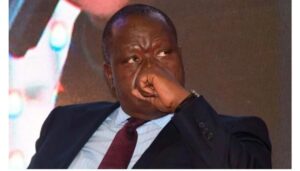

New CBK Governor Dr. Kamau Thugge who chaired the first MPC meeting since his appointment stated that they are going to continue monitoring the policy measures in place and will take necessary actions when needed to.

Dr. Thugge also stated that the country has enough dollars to cover imports for 4 months at 7.3 billion USD.

He added that that credit to the private sector stands at 13.2% which has been steady for the last 2 months.

The surprise loan rate hike by the CBK comes against the backdrop of Monday’s assent of the 2023 Finance Bill by President William Ruto, clearing the way for implementation of the new taxes that take effect from July 1.

The tax proposals are widely expected to exert more pressure on inflation, with the doubling of VAT on petroleum products for instance lifting the cost of fuel by upwards of Sh10 per litre from Saturday this week.

The doubling of the rate of VAT on petroleum products alone is expected to have a compounding effect on not just the cost of transportation but also the prices of food and electricity.

Also read,

Ruto proposes Kenyans to contribute 2.75% of their gross income to NHIF

US responds to the insurrection in Russia

University students set a building on fire as they Protest fee increment

US to blame for recent Alshabaab terror attacks in Kenya, UDA MP

Follow us