KRA boss Muriithi wants outdated annual Finance Bill scrapped

Newly appointed Kenya Revenue Authority (KRA) chairman wants outdated annual Finance Bill scrapped

Newly appointed Kenya Revenue Authority (KRA) chairman wants outdated annual Finance Bill scrapped.

Public finance experts have proposed radical changes to Kenya’s tax regime to ease compliance and improve the operating environment for businesses.

They want the National Treasury to do away with the annual practice of introducing new taxation measures through the Finance Bill, which, they said, would play a part in bringing about predictable taxation.

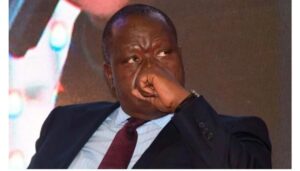

Among them is Ndiritu Muriithi, the newly appointed Kenya Revenue Authority (KRA) chairman, who noted that the clamour by Kenyans and businesses for a stable and predictable tax environment is a genuine concern.

He cited new tax measures that are introduced by the Finance Act every year as among the factors that disorient businesses and leave them unable to plan for the long term.

His sentiments, a possible pointer to the direction that the government could be considering taking, come on the background of the rejection of the Finance Bill, 2024 following the countrywide anti-government protests in June.

While the protests forced the government to withdraw the Bill last year, Finance Bills have over the years introduced unpopular tax measures.

Treasury is currently in the process of preparing the budget, with the expectations of a Finance Bill to be tabled in Parliament in June spelling out new or additional tax measures to help KRA grow tax revenues.

Muriithi, a former governor of Laikipia, cited concerns that local firms have raised over the years that frequent changes in taxation are among the factors that make it difficult to do business in the country.

It is also among the factors that result in low tax compliance.

The KRA chairman, who spoke at a forum convened by the Institute of Public Finance, noted that the Finance Bill has traditionally been part of the budget-making process but added that the 2010 Constitution has since changed this process and the tax-raising measures should also change.

“The need for an annual Finance Bill is a historical thing. I do not see any technical reason why it should be done the way it is done other than the weight of history,” he said.

“(Historically), price adjustments were an annual thing when we had price controls. The Minister for Finance would come to Parliament and explain how prices would change…(some of them effective) from midnight (on the day the budget was read).”

2 Mt Kenya governors slam DP Kindiki for abandoning the region

We have too much ‘wickedness’-Dorcas Rigathi scathing critique of Kenya’s moral state

Body of a woman found dumped near Lang’ata Cemetery

Dorcas Gachagua forced to flee after Maina Njenga storms prayer meeting

Trump illegal migrant mass deportation raids to start on day one, US media report

He explained that then, the Treasury kept the budget-making process a secret, unlike today when the Constitution requires the Treasury to open up and involve Kenyans in the process that starts early in the financial year.

Muriithi added that there is little point in keeping the relic that had made taxation unpredictable.

“Is there room to go for two years, three years, maybe even longer, during which not too much is changing? I think there is and that this is something that is desirable and that we ought to adopt,” he said.

“It is the debate that we should be having within government but also with (Kenyans) so that the frequency of change is manageable.”

He noted that even the Treasury documents such as the Budget Policy Statement and the Meditem Term Revenue Strategy have projections for several years ahead.

“The foundational thinking is that we should be looking at about five years as the period within which we are planning so that we increase certainty both in terms of government finances and the rest of the economy,” said Muriithi.

The finance bills are supposed to help KRA to meet the tax revenue collection target set by the Treasury.

Also read,

Ruto’s CS goes after Uhuru Kenyatta after his message to Gen Zs

Kenya sends another 200 police to Haiti

ODM must not be part of Ruto’s praise and worship team; Sifuna, Orengo lash out at party leaders

Rigathi Gachagua breaks silence after Maina Njenga disrupted wife’s prayer meeting

JSC revokes 11 Court of Appeal judge vacancies amid controversy

Follow us