Employers raise alarm as deductions cross two-thirds of pay

Salaried workers have had their payslips shrink due to statutory deductions with employers saying the new levels have breached the limit

Salaried workers have had their payslips shrink due to statutory deductions with employers saying the new levels have breached the limit.

Recent months have seen an increase in salaried workers whose take-home pay has decreased below the legally recommended amount after statutory and tax deductions, causing a compliance challenge for employers and financial institutions.

According to the Employment Act of 2007, employers are not allowed to take more than two-thirds of an employee’s basic salary in order to protect their legal employment benefits.

Salaried workers’ take-home pay has decreased due to an increase in NSSF contributions from KSh200 to up to Sh1,080 and the beginning of a 1.5 percent housing levy deduction from gross pay.

Employers claim that rising interest rates and new statutory deductions have dramatically increased the monthly deductions on employee payslips, reducing take-home pay for workers in a high-cost-of-living environment and putting companies at loggerheads with the law.

“There has been quite an increase in the level of breach with what the Employment Act requires. It is a big problem and we have had engagements with the government. Other than the statutory deductions, people have their commitments like loans, mortgages, and fees,” Jacqueline Mugo, the executive director and CEO of the Federation of Kenya Employers (FKE), said.

“There is a need for the government to harmonize these deduction laws. What do we obey? Do we obey the Employment Act or others like for housing levy and pension? At the end of the day, all these are laws and none supersedes the other except the Constitution.”

The increase in State deductions has made it more difficult for employees who accessed loans based only on their paystubs.

In July, the weighted average interest rate for banks reached 13.5 percent, which is the highest level since March 2018.

Supporters dump raw sewage at County Assembly’s offices ahead of Governor’s impeachment motion

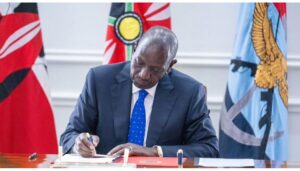

Ruto makes a U-turn as he reverts back to Uhuru’s Naivasha port

Inside U.S., Kenya defense agreement ahead of Haiti deployment

Kenya Power announces power shutdown in SIX counties

Government to limit access to FIVE critical services to those using digital ID Maisha Namba

Many businesses have violated the Employment Act of 2007, which states that deductions from an employee’s pay, whether statutory or voluntary, should not exceed two-thirds of their entire income, as a result of the additional deductions.

“The total amount of all deductions which may be made by an employer from the wages of his employee at any one time shall not exceed two-thirds of such wages or such additional or other amount as may be prescribed by the Minister,” states the Act.

Bankers said that the enhanced contributions towards the National Social Security Fund (NSSF) and the new housing levy were substantial and have even affected the financial plans of many workers.

Faced with this development, some banks are now opting to restructure loans to ease the pain on affected employees while some workers are cutting down on voluntary savings such as those in Saccos and banks to survive.

“There is going to be a transition challenge and then there will be a reset sooner than later. Our intention as a bank is to ensure people can pay loans so we have been accommodating cases where we can extend loan tenors,” said Kariuk Ngari, the Standard Chartered Bank Kenya CEO, in a phone interview.

Also read,

Hard times as Kenya’s debt interest payment rise to a record Sh231.6bn

Fracas as matatu driver arrested for charging police officer fare (VIDEO)

Employers, workers vow to oppose the introduction of more taxes ‘pay slips squeezed to the limit’

DP Gachagua, Governor Sakaja snub each other at Ruto event (VIDEO)

Billionaire sugar investor Rai responds on shutting down operations in Kenya after recent abduction

Ruto responds on proposal to increase presidential term limit to SEVEN years

Follow us